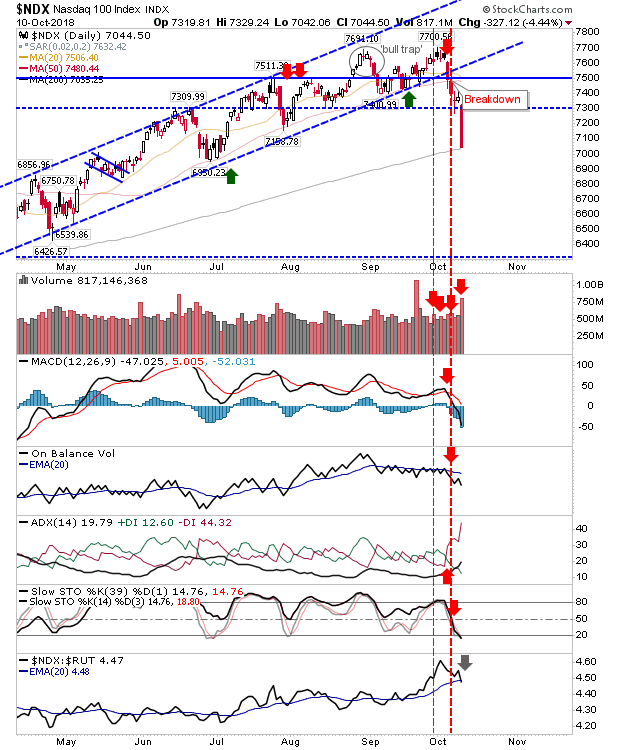

Indices Defend 200-day MAs

Last week's selling had put pressure on markets not seen since 2016 but the run of good form has meant Tech and Large Cap Indices are only now testing 200-day MAs. There was a brief overshoot on Thursday but the week closed more settled. The S&P did well to make it back to its 200-day MA but it complicates the risk:reward which now has a loss of 2,710 as the place for a stop which is well outside most comfort zones. Given that, I would look for some retest of 2,710.