Thursday's Gains Consolidate

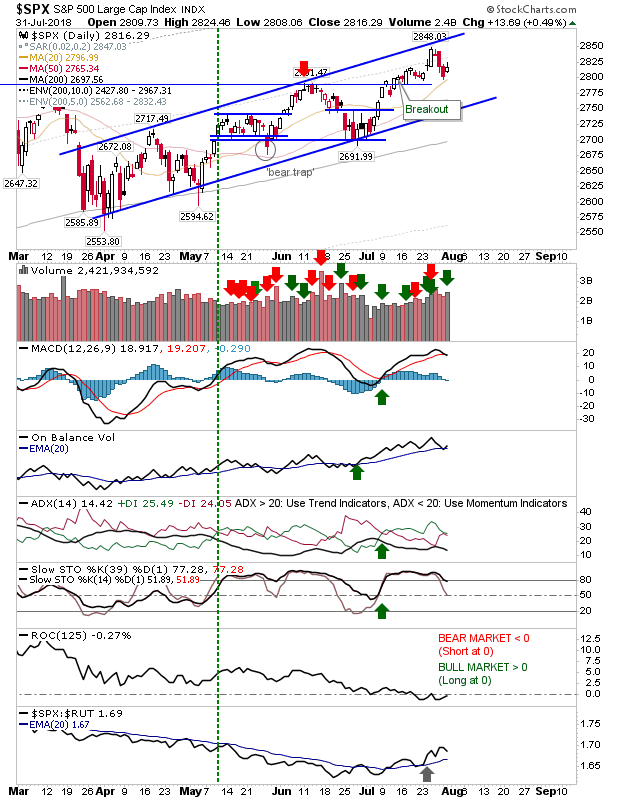

Large Caps continued to press Thursday's advantage with gains to send indices towards recent swing highs. The S&P remains on course to reach channel resistance and post new highs with technicals net bullish and relative performance in the ascendancy against Small Caps.