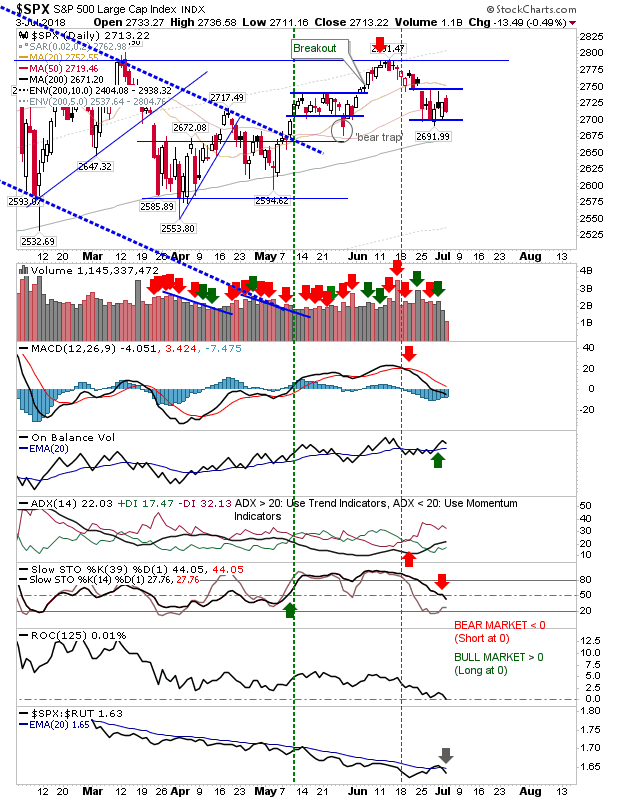

It was by no means a disaster but there was an ominous feel to Wednesday's close. Bulls had used the momentum built by last week's gains to make a run at all-time highs but profit takers and shorts used this as an opportunity to get out/build a position. It's a typical stage I reaction to a resistance test but now it's a question if there is enough sideline interest from bulls to drive a break to new all-time highs and force today's shorts to cover. The S&P left a small 'bull trap' on low volume. Technicals are net bullish so if bulls can come back and reverse the 'bull trap' it would nicely set up a run to test newly drawn channel resistance. But for now, shorts look favoured.