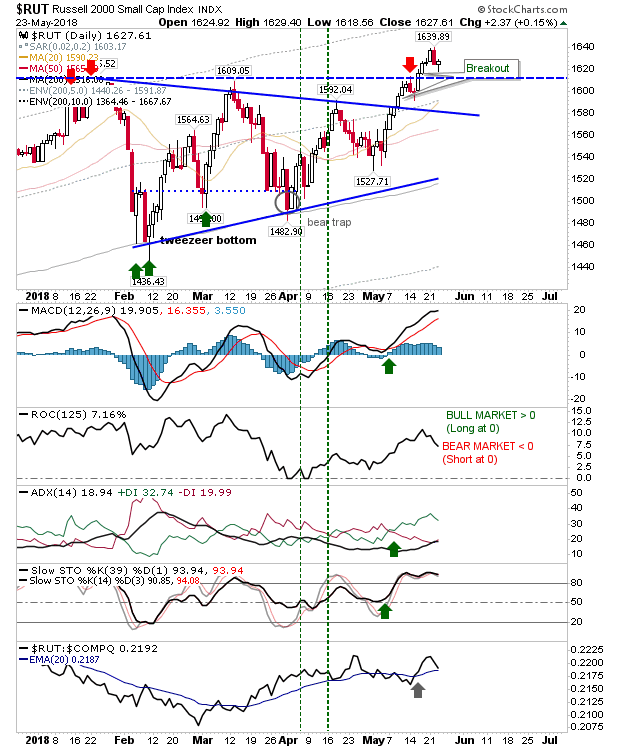

Base Building Continues

Another Day inside the trading range, another day of waiting. Not a whole lot to say about Friday. The S&P remained tightly bound and confined to a narrow horizontal range. On-Balance-Volume switched to a 'sell trigger' as other technicals remained positive. The preferred trade is still an upside breakout from the hande.