Bearish Candlestick Creep

Friday's action was a case of status quo but Monday pushed things more towards bear's favour; the series of doji and one gravestone doji are more in line with a swing highs. It does give a bulls a chance to negate what are typically bearish signals, particularly as these rallies are still relatively young.

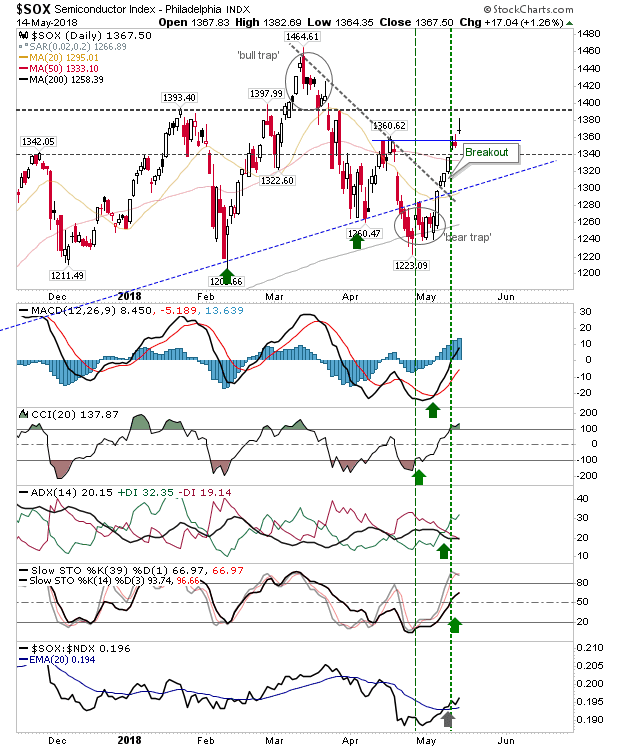

The gravestone doji manifested itself in the Semiconductor Index. While today's action also marks a short term breakout it's looking more likely to be a swing high; look for a gap down tomorrow (to leave a potential bearish 'evening star').

The Russell 2000 had a more bearish close (not quite an engulfing pattern), enough to confirm resistance at the last swing high in January. A push back to the 20-day or 50-day MA would be welcome. Technicals are all net bullish so the expectation is for an eventual breakout to new all-time highs.

The S&P expressed a narrow doji just above the April Spring high on bullish net technicals. The picture still looks good for bulls even if today was a bit of a non-event for the index.

The Nasdaq tagged resistance but was unable to break through; it'd s minor resistance level but a move to challenge the 'bull trap' would bring the index in line with the Russell 2000.

For tomorrow, indices have work to do to negate today's generally bearish setups and breakout out higher. Bulls can be aggressive in working for a breakout but even if tomorrow sees a lower finish it won't take long before a support level is hit.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free. I invest in my pension fund as a buy-and-hold.

The gravestone doji manifested itself in the Semiconductor Index. While today's action also marks a short term breakout it's looking more likely to be a swing high; look for a gap down tomorrow (to leave a potential bearish 'evening star').

The Russell 2000 had a more bearish close (not quite an engulfing pattern), enough to confirm resistance at the last swing high in January. A push back to the 20-day or 50-day MA would be welcome. Technicals are all net bullish so the expectation is for an eventual breakout to new all-time highs.

The S&P expressed a narrow doji just above the April Spring high on bullish net technicals. The picture still looks good for bulls even if today was a bit of a non-event for the index.

The Nasdaq tagged resistance but was unable to break through; it'd s minor resistance level but a move to challenge the 'bull trap' would bring the index in line with the Russell 2000.

For tomorrow, indices have work to do to negate today's generally bearish setups and breakout out higher. Bulls can be aggressive in working for a breakout but even if tomorrow sees a lower finish it won't take long before a support level is hit.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free. I invest in my pension fund as a buy-and-hold.