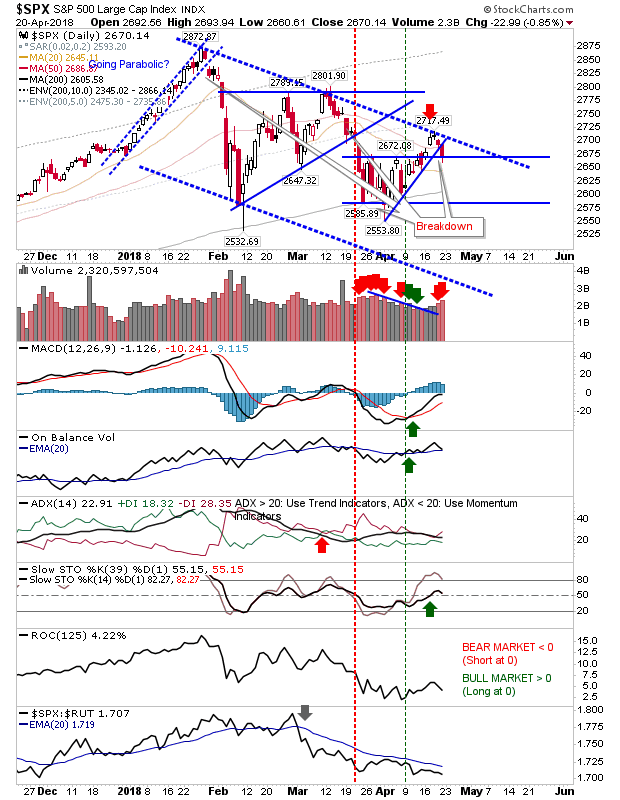

Mixed Setups; Something for Bulls and Bears

Markets started the day strong - challenging resistance - but were unable to press this advantage. Many indices closed lower, leaving 'black candlesticks' which are typically bearish when formed at 'swing highs' but still favor weakness even in the absence of the swing high setup. The 'black candlestick' for the Nasdaq at resistance suggests a move towards the 200-day MA but for this to happen there needs to be an immediate downside; any recovery has a strong chance of negating the 'black candlestick'.