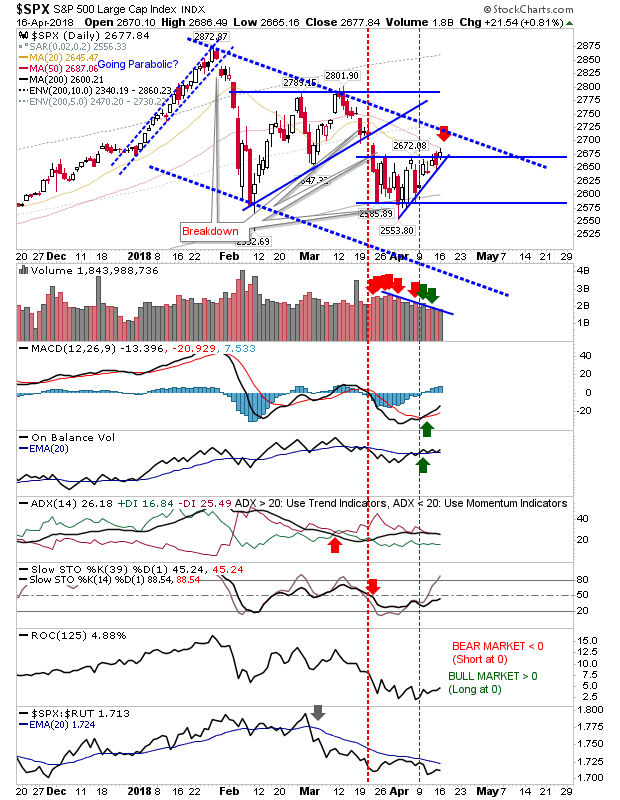

Short Opportunity Negated

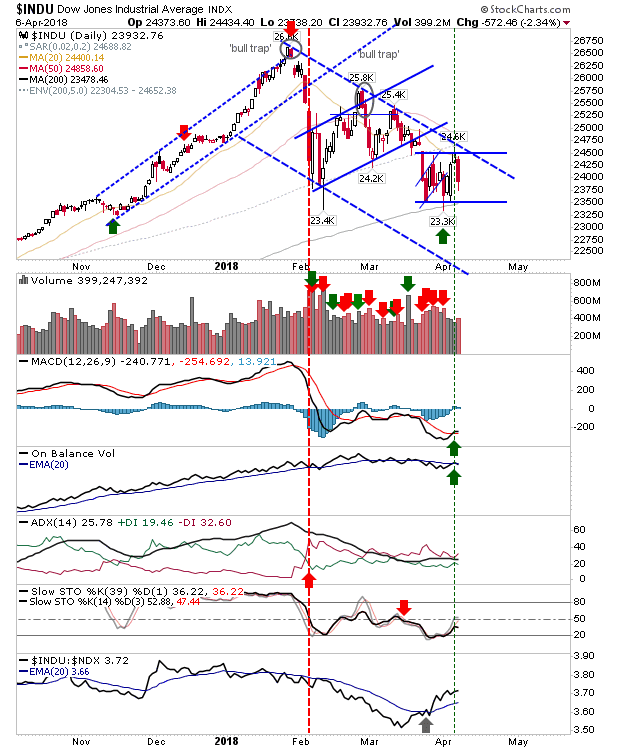

Well, that didn't last long. The shorting opportunities which offered themselves yesterday didn't last the morning; morning gaps held beyond the first half-hour of trading and bar a small sell-off into the close markets finished higher and above key moving averages and trading channels. The Dow created a breakout which now offers a potential long play. Stops go on a loss of 24,600. Technicals finished with a new long 'buy' trigger in Stochastics.