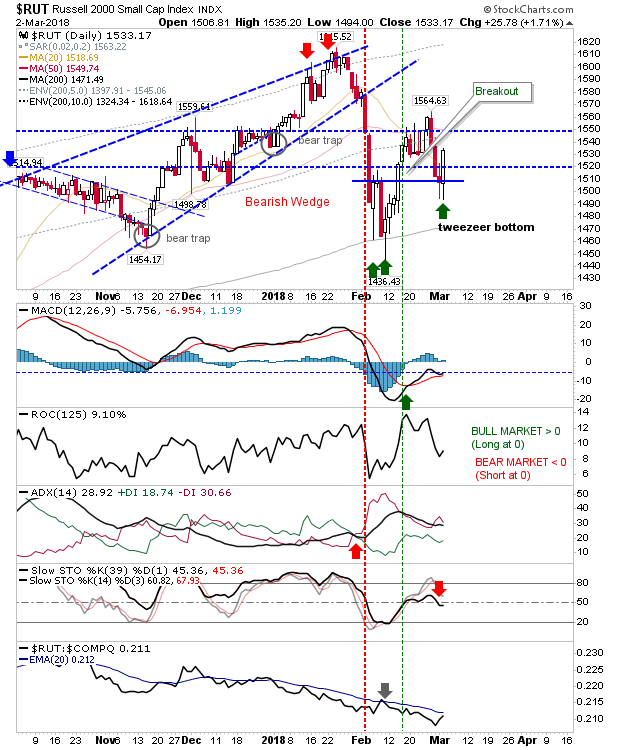

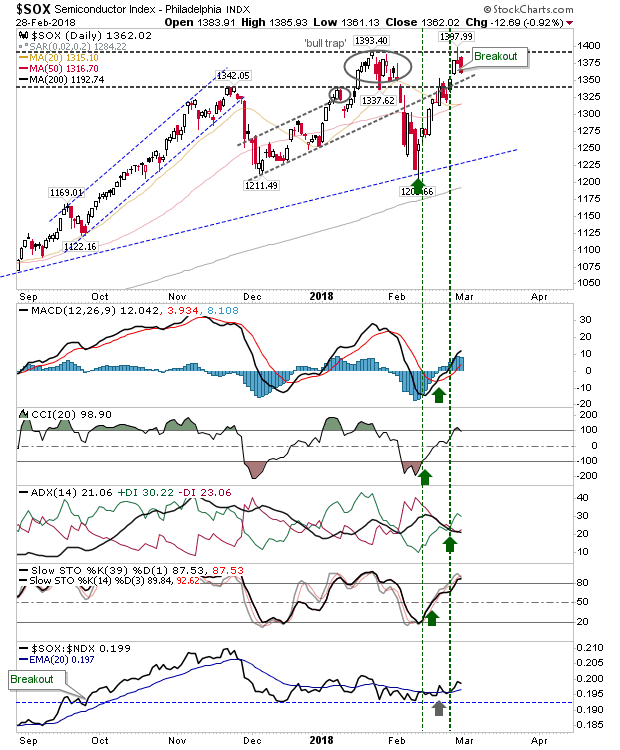

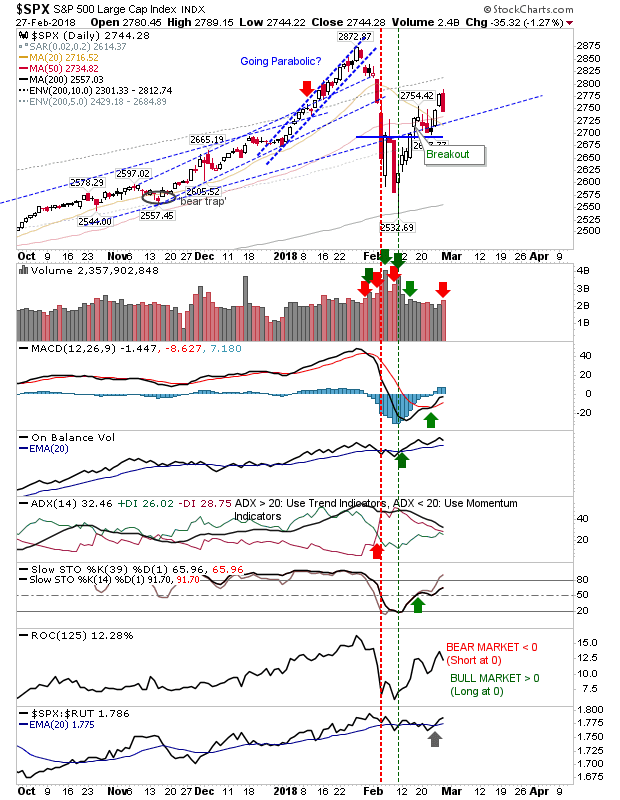

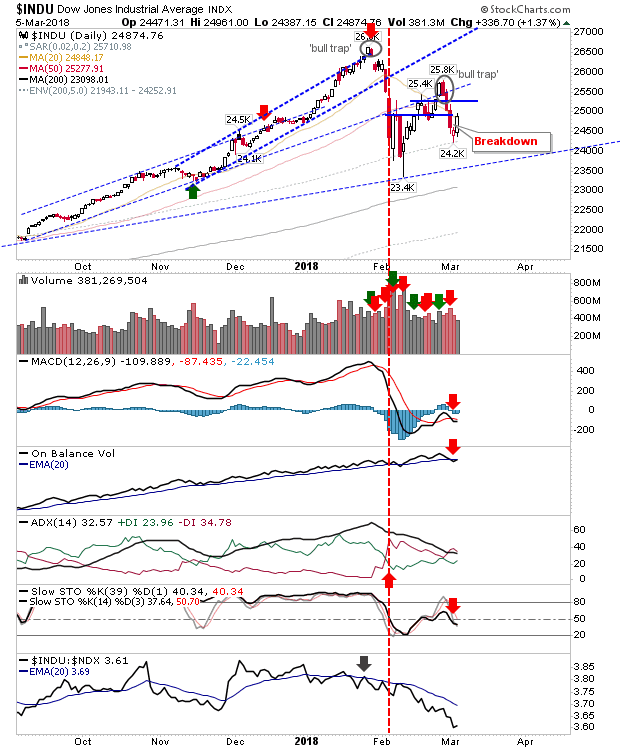

Markets Continue To Map Swing Lows

A solid day for indices as markets continued the good work from Friday. Even the Dow Jones was able to firm up a potential 'bullish morning star' sequence. There is still work to do but this looks better for bulls with anyone considering a short trade lacking a natural point of attack (yet).