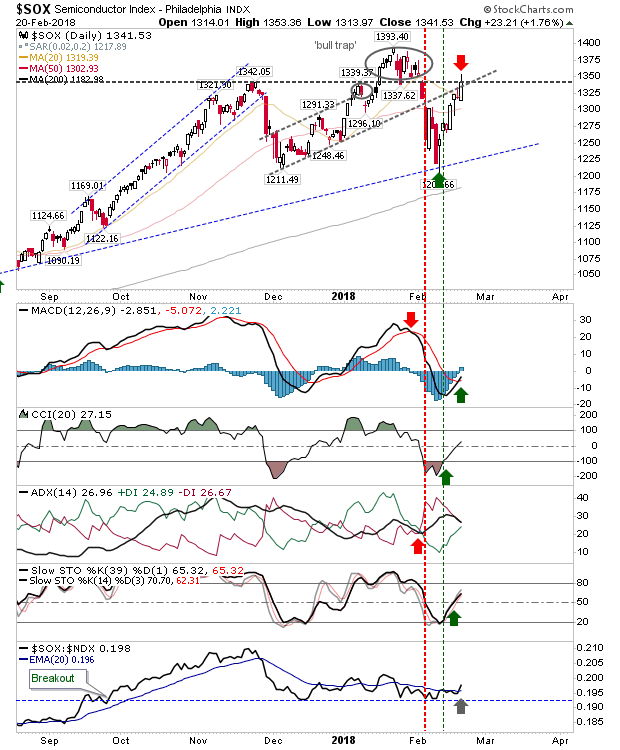

Last Week's Weakness is No More

It was looking to be a struggle after last week's series of 'inverse hammers' had set up what looked like swing highs for indices but these have been cleared by today's gains. In the process of doing so the S&P closed above the 20-day MA with 'buy' signals in the MACD, On-Balance-Volume and Stochastics. Only relative performance is underperforming.