Markets Continue To Map Swing Lows

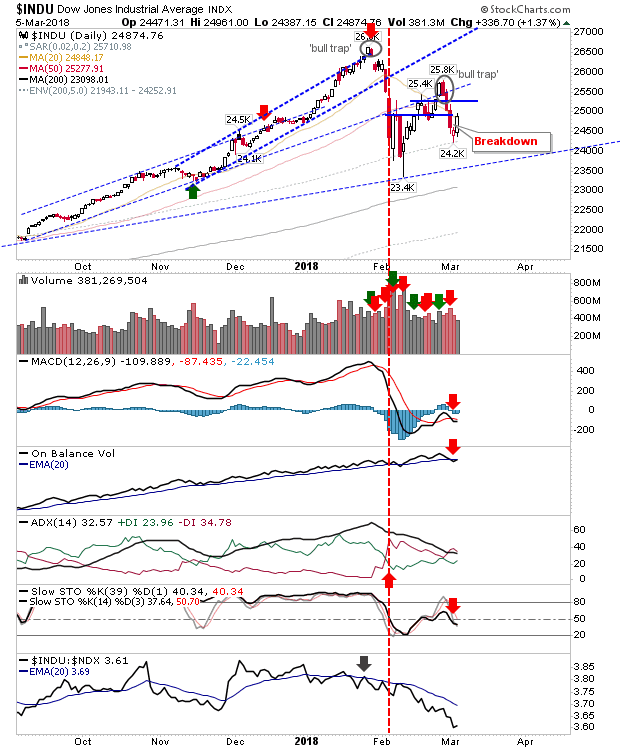

A solid day for indices as markets continued the good work from Friday. Even the Dow Jones was able to firm up a potential 'bullish morning star' sequence. There is still work to do but this looks better for bulls with anyone considering a short trade lacking a natural point of attack (yet).

The Semiconductor Index is just a few points shy of a breakout and continues to be the index likely to lead out the next rally (or fake it).

The Russell 2000 will be looking to challenge 1,564 tomorrow. A break of this swing high will attract sideline money to trade into its next challenge of the all-time high of 1,615. There was an uptick in relative performance after months of weakness; if this metric crosses its moving average it will act as a confirmation trigger for a possible leadership switch back in favour of Small Caps.

While Small Caps are making inroads against the Nasdaq, the latter index is out-performing the S&P with a sequence of new highs. Existing longs have no reason to sell yet (trailing stops on a loss of 7,085).

Finally, the S&P is coming into testing converging 20-day and 50-day MAs resistance as it works to challenging (and negating) the 'bull trap'. If there is an index which is going to struggle tomorrow the S&P will be it.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Semiconductor Index is just a few points shy of a breakout and continues to be the index likely to lead out the next rally (or fake it).

The Russell 2000 will be looking to challenge 1,564 tomorrow. A break of this swing high will attract sideline money to trade into its next challenge of the all-time high of 1,615. There was an uptick in relative performance after months of weakness; if this metric crosses its moving average it will act as a confirmation trigger for a possible leadership switch back in favour of Small Caps.

While Small Caps are making inroads against the Nasdaq, the latter index is out-performing the S&P with a sequence of new highs. Existing longs have no reason to sell yet (trailing stops on a loss of 7,085).

Finally, the S&P is coming into testing converging 20-day and 50-day MAs resistance as it works to challenging (and negating) the 'bull trap'. If there is an index which is going to struggle tomorrow the S&P will be it.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.