Sellers Double Down

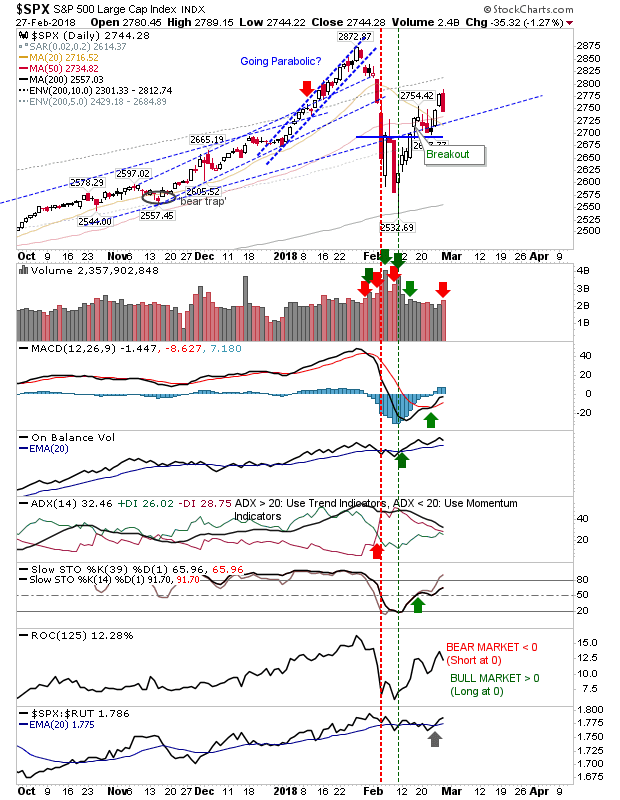

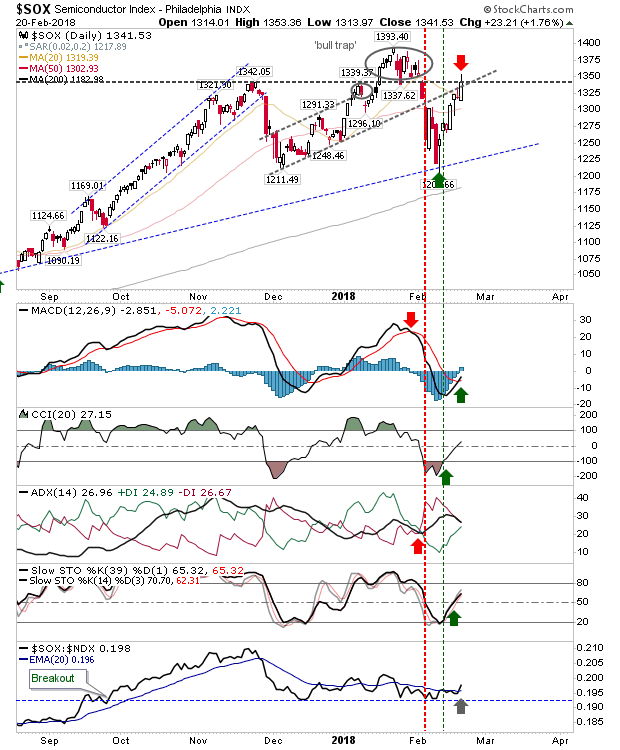

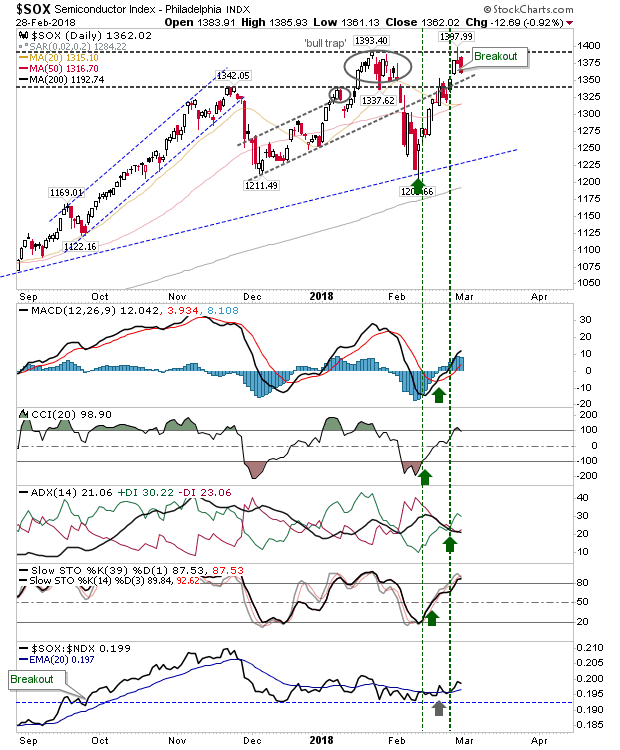

Yesterday established a round of profit-taking after Monday's breakouts had suggested something more positive in the works. Unfortunately, another round of selling ranking as higher volume distribution left indices in a more precarious state. The Semiconductor Index had come close to tagging 1,400 but the index looks to have confirmed a bearish 'evening' star as part of a double top. A drop below 1,340 would send bulls running to the hills and open up tests of the slower rising channel and 200-day MA.