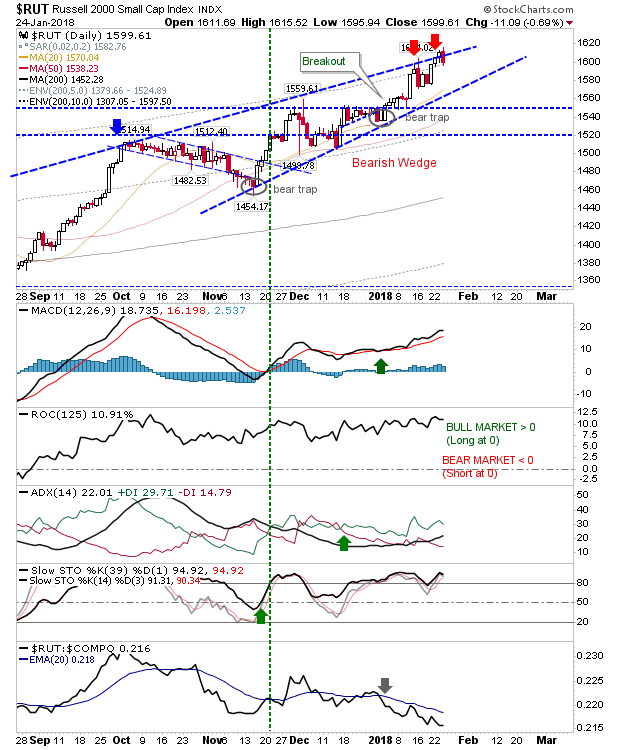

Bearish Wedge in Russell 2000?

It's a bit of a grasp given strength across markets but the Russell 2000 may be shaping a bearish wedge. There are three tags of resistance but it's rising support anchored by the two 'bear traps' which suggests a possible wedge. Today's bearish engulfing pattern also contributes.