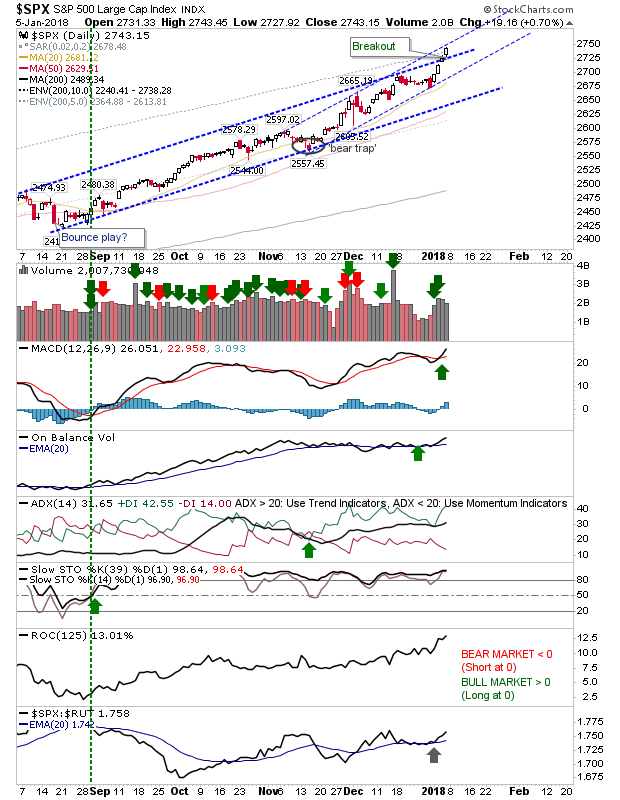

Russell 2000 Tags Resistance As S&P Breaks (Again!)

I forgot to mention last week that the S&P has reached the "15% of Profit Take" zone of historical price action relative to the 200-day MA dating back to 1950. If it reaches 1,653 it will be in the 5% percentile of historic action - a 'strong sell' signal. The price tag came with a fresh breakout from the channel; the second breakout in 2018.