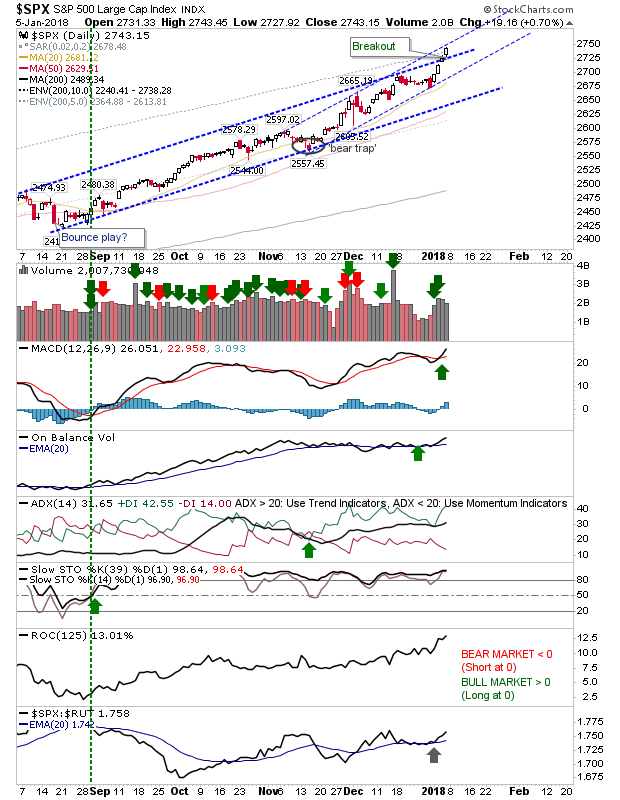

Another Acceleration in the Rally

Another day of gains pushed Indices to new highs and offered a breakout from the accelerated channel for the Nasdaq but it was the Russell 2000 which took the biscuit. The Russell 2000 added nearly 2% as buyers swooped in to take advantage of recent quiet action. This follow on to the recent breakout sits the index up nicely for further gains.