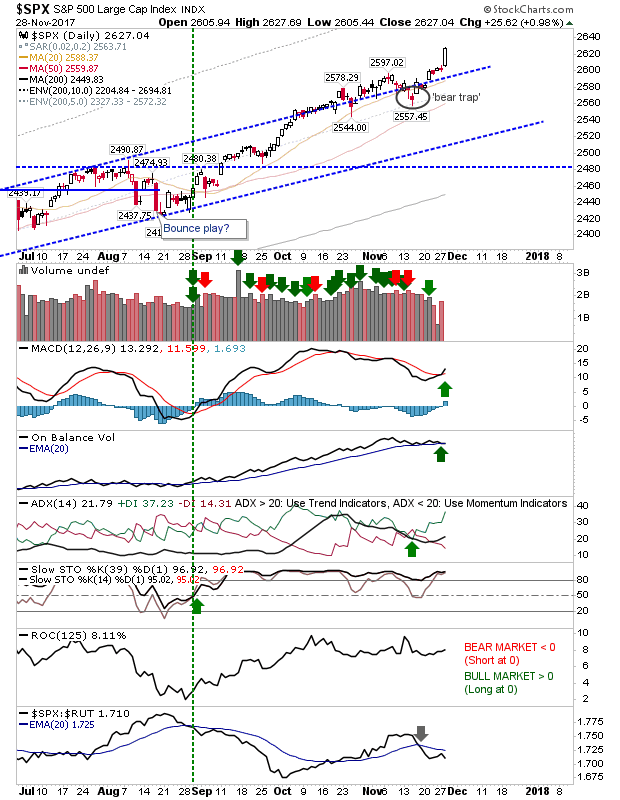

Large Caps (Financials) Make The Jump Against Tech

In the end, it wasn't Tech to surprise with an acceleration past its bullish rising channel but the S&P and Dow with fresh breakouts. A confluence of positive data fueled the advance in Large Caps along with a dollop of short covering. Tuesday's action ranks as a breakout in this indices and brings into play new support levels should profit-takers come in to take advantage of the gains. The only downside for the S&P was the continued downtrend in relative performance against Small Caps - suggesting the real money is flowing into more speculative issues.