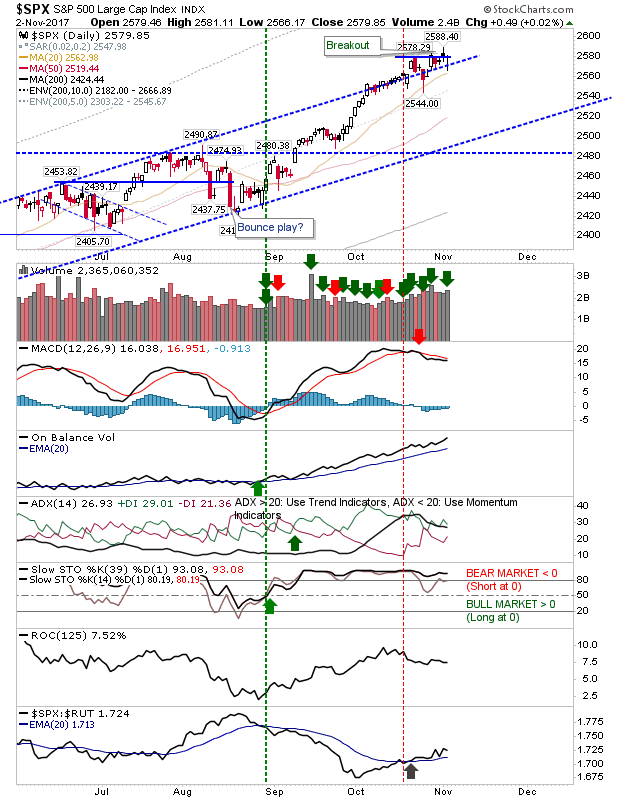

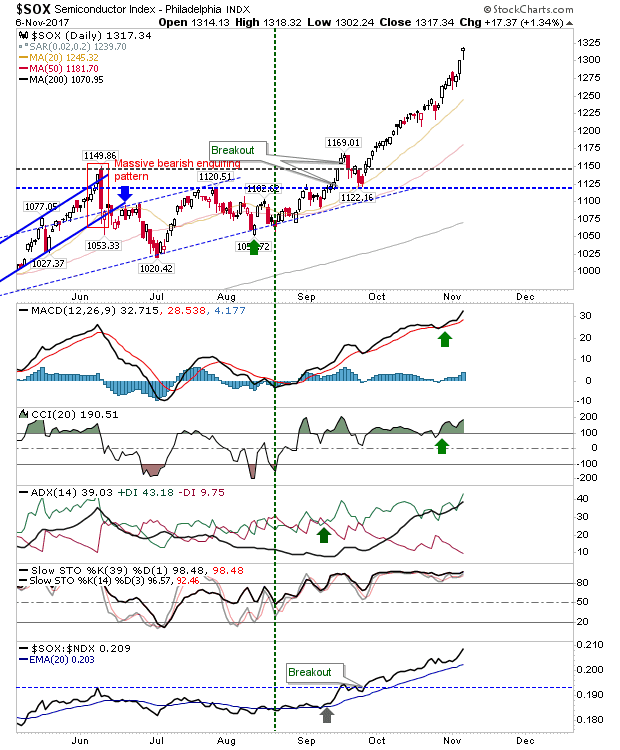

Semiconductor Index: Shooting Star? Russell 2000 to Breakout

More gains for the market kept the rally intact which leaves little to add today. The only potential cloud on the horizon is the Semiconductor Index. Today finished with a gap higher with a bearish hammer which may become a bearish shooting star if there is a gap down and further losses by the close tomorrow. The rally from September lacks a pullback so some form of sell off is anticipated