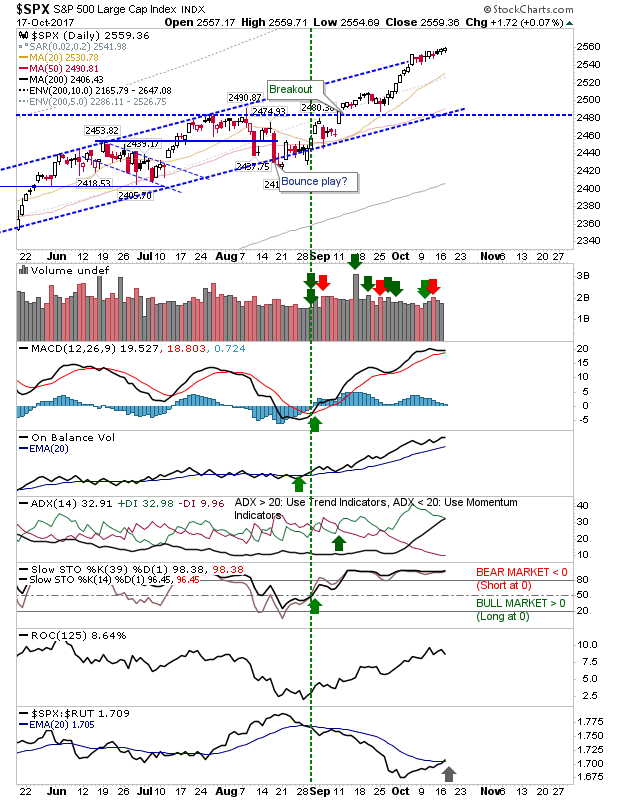

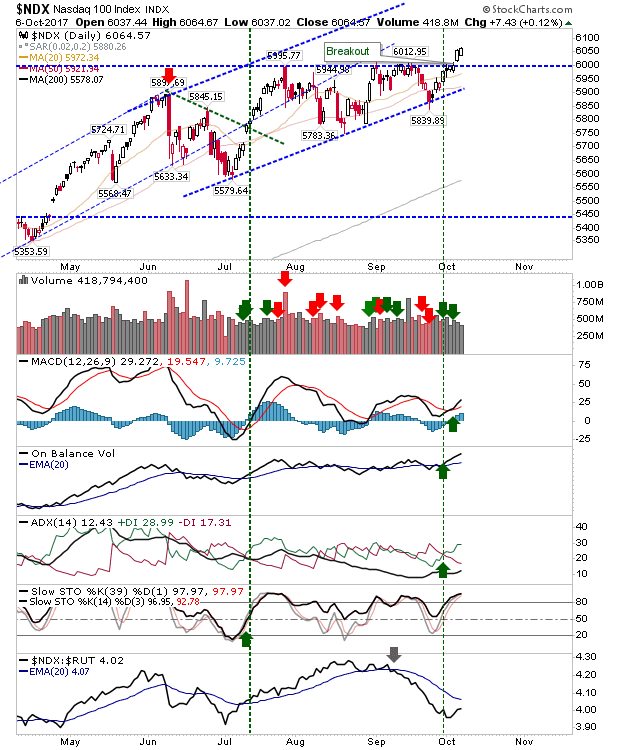

About four years ago I went to a Bloomberg hosted talk on Market Cycles. I have been wracking my brain and Google trying to find the presentation and speaker name (which was available on line) but I thought the talk interesting enough to market in my Google calendar the date for the New Moon in October 2017, which was a focus point convergence of a number of market cycles and potentially a significant market top event (the countdown clock in the sidebar). The years have since ticked by and we are not just a couple of days from the October 2017 New Moon. The market has at least cooperated by sitting at new all-time highs but whether this evolves into a major top remains to be seen. I'm mad with myself that I can't find in my pinboard or delicious bookmarks the link so all I can say is the day will soon be upon us and let's see what happens from there... Other than speculating on the big 'what-ifs' there is very little to say about the market in recent days. Action