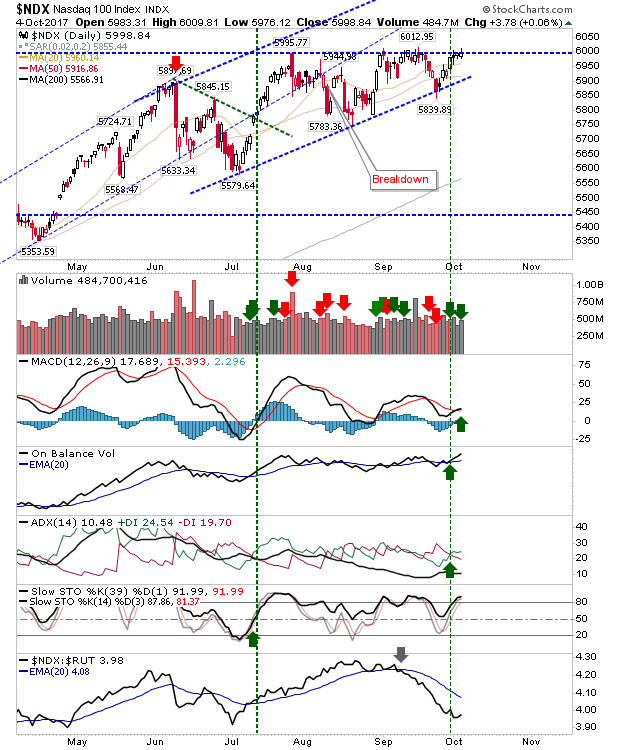

And the wait goes on (for the Nasdaq 100)...

The index which looked ready to the pop spent another day on the sidelines. There is little room for maneuver for either side so if the Nasdaq 100 doesn't pop tomorrow it's hard to know when it will. Volume climbed in accumulation and the MACD triggered a new 'buy'.