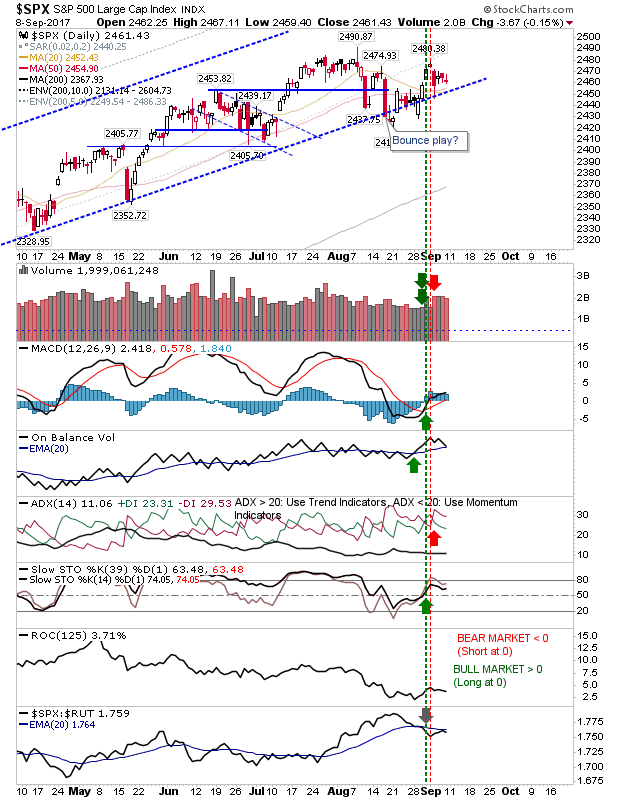

Still Waiting For Tech Breakout But Omens Good

Expiration Friday pushed some heavy volume through the markets but the buying wasn't enough to bring about much-anticipated breakouts for the Nasdaq and Nasdaq 100. However, Friday's action suggests all remains good for this to happen early next week. But any drop below 5,900 in the Nasdaq 100, and 6,350 in the Nasdaq has the potential to set up a cascade of (long) stop hits. For the Nasdaq, anyone who took advantage of the channel support hit mid-August (green arrow) will be sitting pretty. I would be looking for a move back to channel resistance.