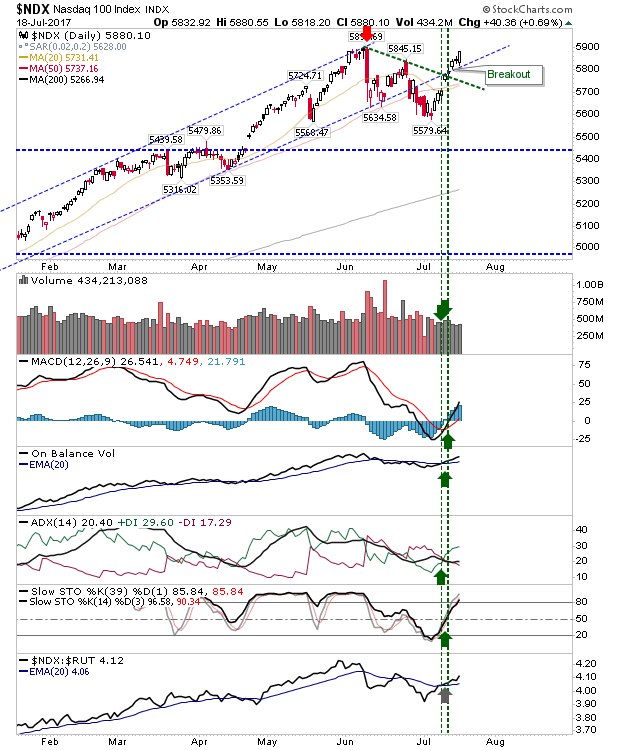

After Thursday's selling there was more downside on Friday which put further pressure on support. The indices best placed to take advantage were the Nasdaq and Nasdaq 100. The Nasdaq touched 6,350 support for the second day in a row. Selling volume was down on Thursday's but as selling didn't violate Thursday's low there is an opportunity for an aggressive long. However, day's like Friday aren't typically bullish but until the market proves otherwise the risk:reward isn't too bad for bulls. Buyers of the Nasdaq can set stops below 6,335. Technicals are bullish. An opportunity to take a chance? The Nasdaq 100 is at rising support with a stop on a loss of 5,865. The Semiconductor Index is trading inside the wide bearish engulfing pattern from Thursday. There is a 'sell' trigger in the CCI along with a loss in relative performance against the Nasdaq 100. The convergence of 20-day and 50-day MAs is an opportunity for bulls to counter the tr...