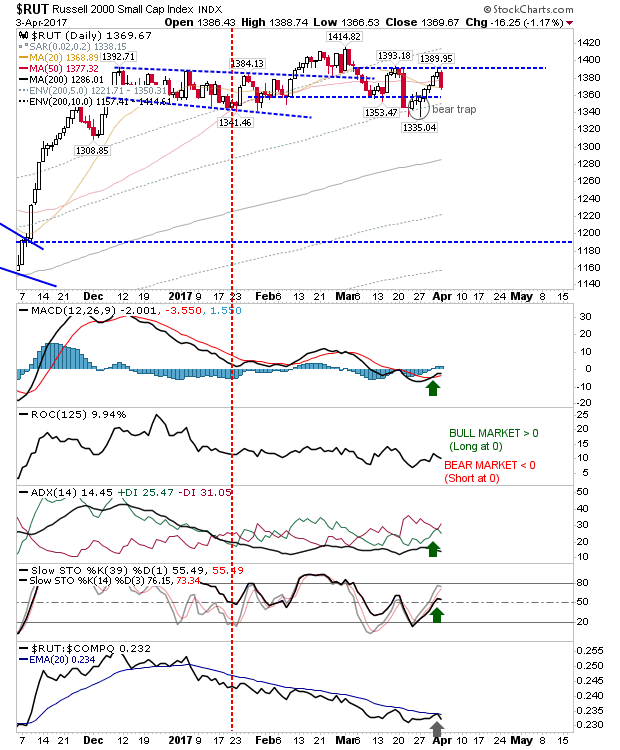

Markets Take Late Hit

Sellers swoop in afternoon trading to whip nascent demand built after a positive open. The sell off was attributed to an indecisive Federal Reserve , but profit taking can occur at any time when an extended series of small gains is undone by one big day of selling. Volume rose in confirmed distribution. The index most vulnerable heading into today was also the one to suffer most at the hands of sellers. The Russell 2000 suffered a big hit as it dropped over 1%, moving away from its 20-day and 50-day MAs. The 'bear trap' hasn't been negated, but it's under pressure. The Nasdaq came back off resistance without registering an attempted breakout. The potential MACD trigger 'buy' failed, although other technicals are still okay. The S&P experienced a bearish engulfing pattern as it turned away from nearby resistance. It too registered distribution and technicals are weakening. Further selling is looking probable here. Interestingly, the Nasdaq ...