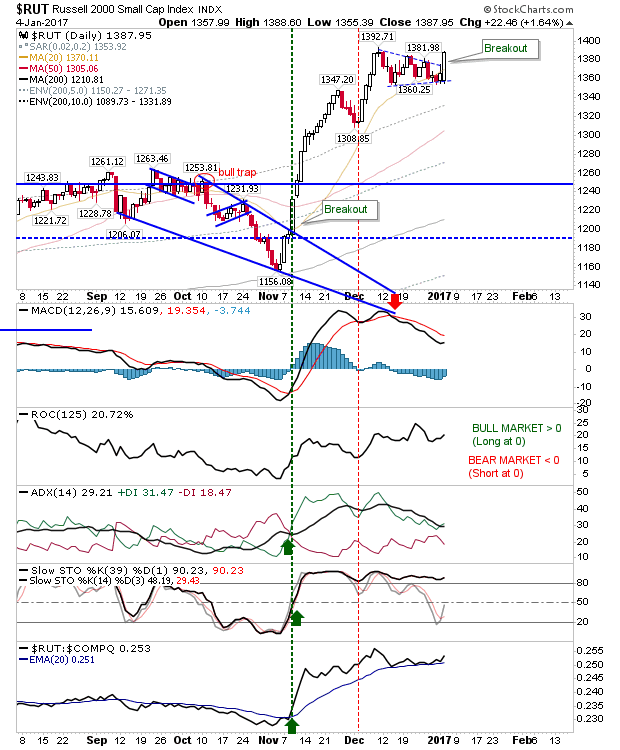

Small Caps Feels The Heat

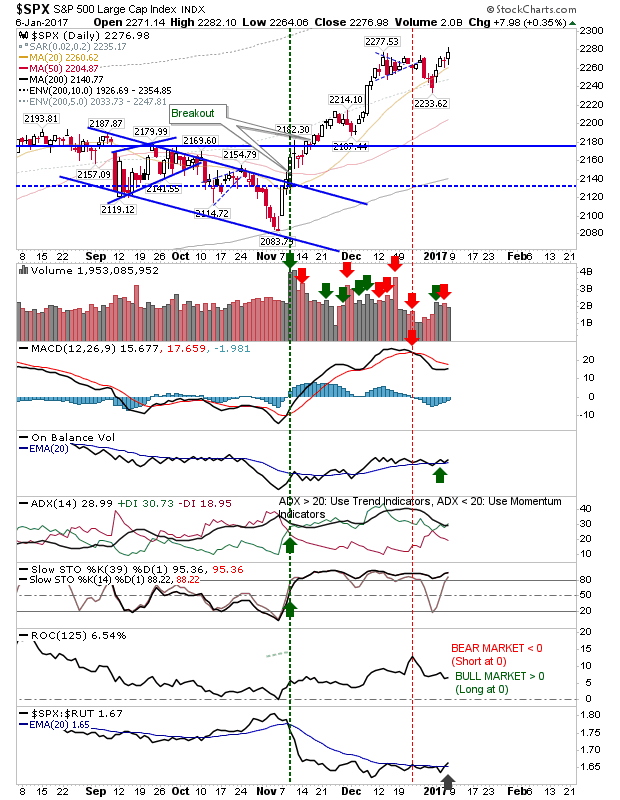

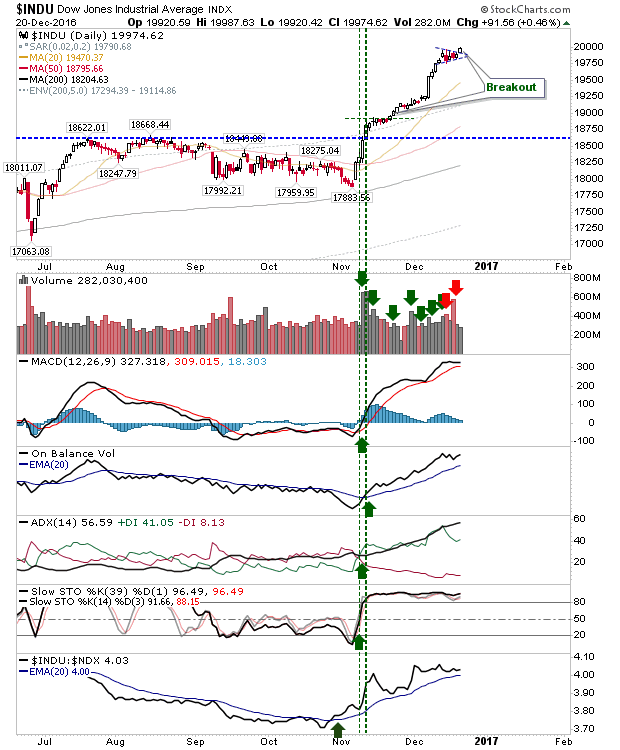

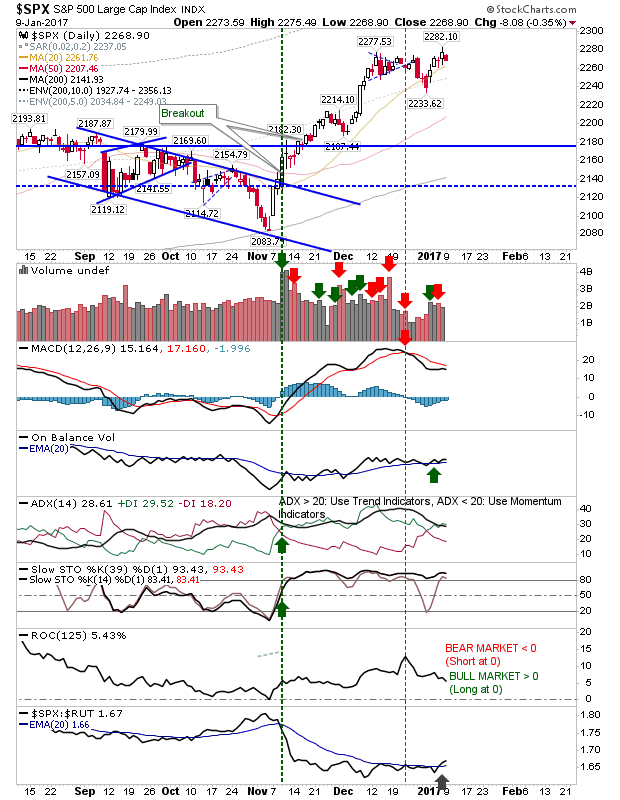

It was a generally quiet day for markets with Small Caps feeling most of the pressure. The S&P took a quarter percentage loss as it gave back a small amount of last week's gain. There was no technical change on this loss. Nothing to be too concerned about.