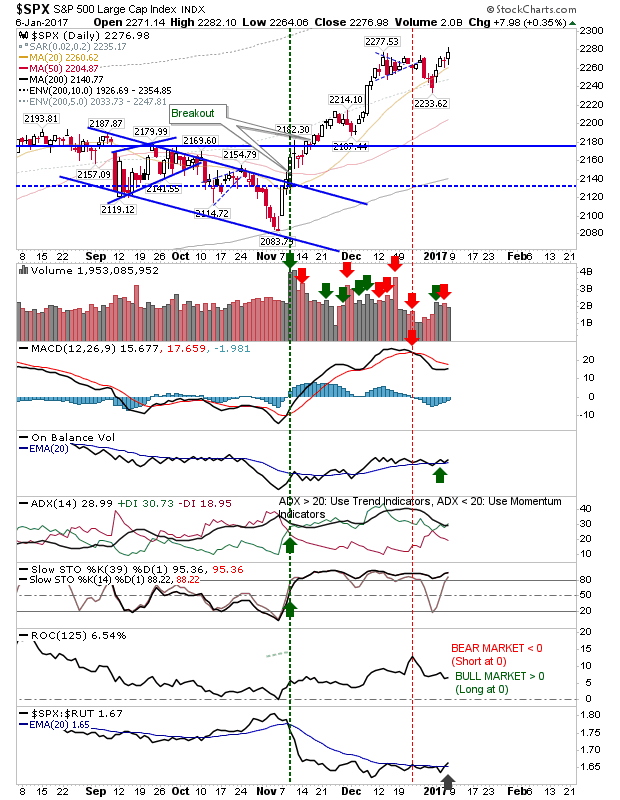

First Week of 2017 Ends on High

The bright start to the year continued as bulls were able to maintain buying pressure for three of the four first trading days of the year. The S&P closed near the highs of 2016 with all key moving averages in upward trends. The MACD is still holding to a 'sell' trigger, but this is heading towards a new 'buy' trigger, which given the strong position relative to the zero line would instead register as a pullback 'buying' opportunity.