Friday's Action Overshadowed By Thursday's Buying

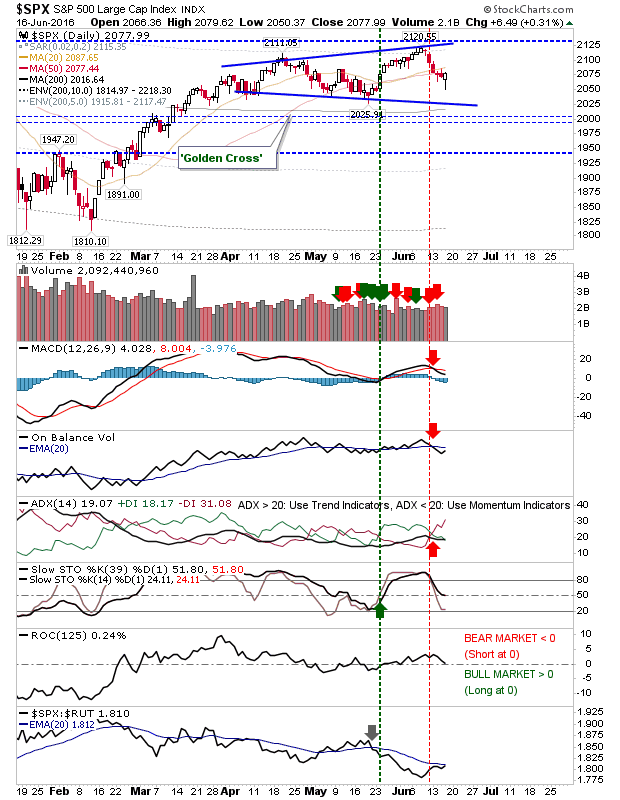

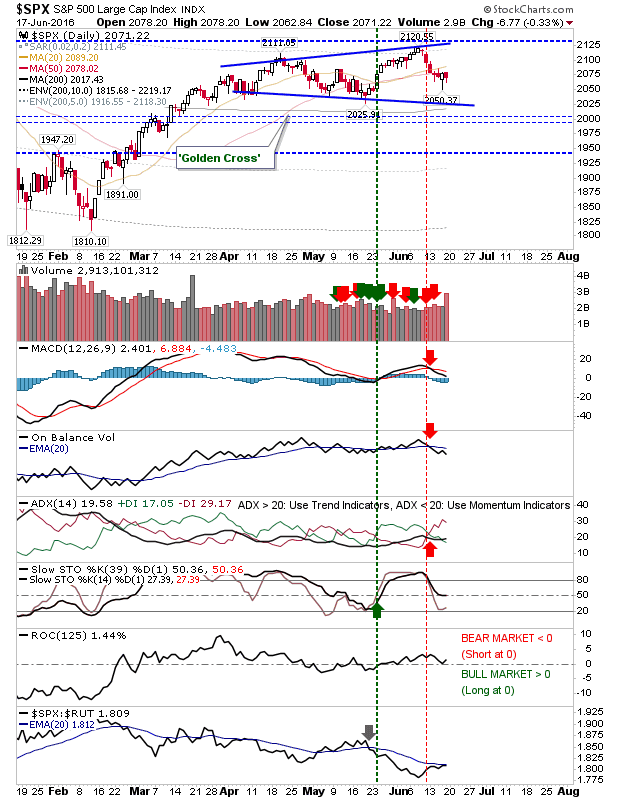

Bears returned on Friday, but weren't able to undo the action of bulls from Thursday. Volume did climb, registering as distribution, but Thursday's lows held. The S&P turned net bearish with stochastics [39,1] crossing below the mid-line. While relative strength (to the Russell 2000) improved.