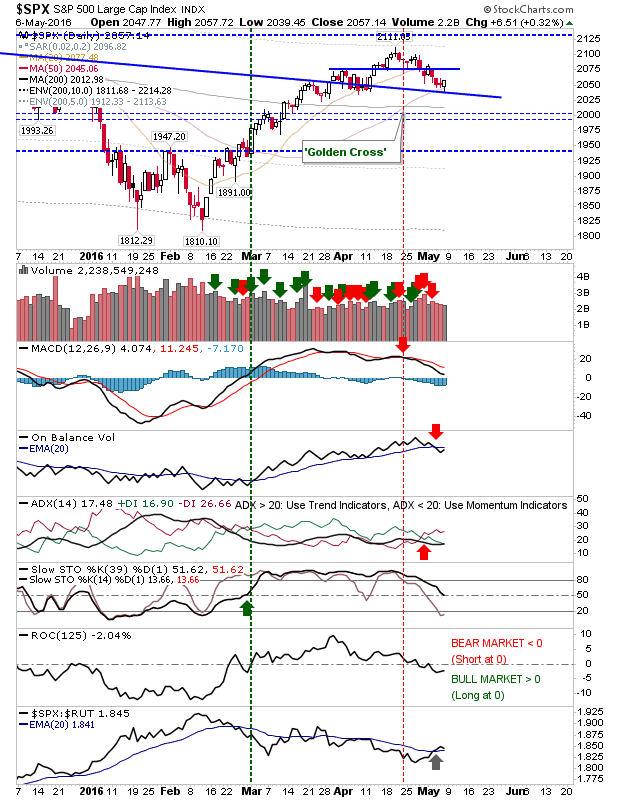

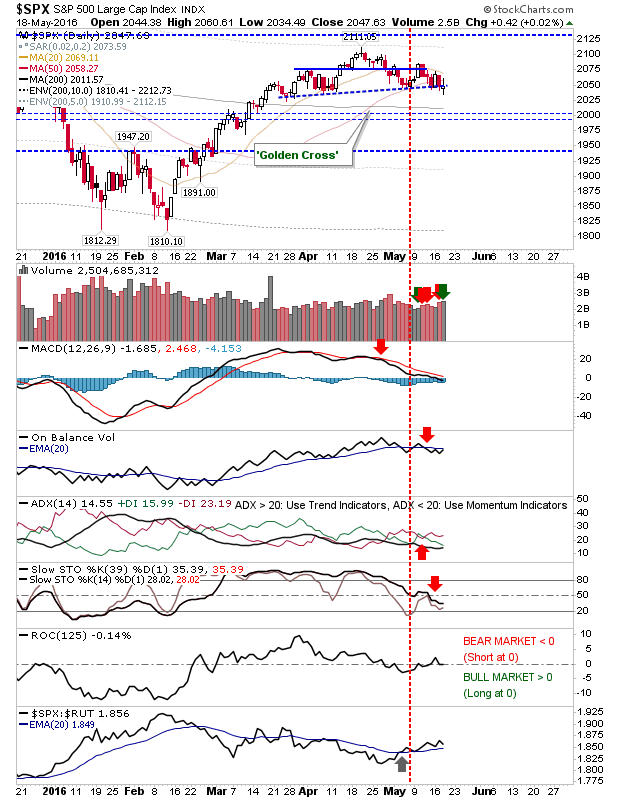

Losses Outscore Gains

Small gains fail to recover yesterday's losses. The trend is down, but losses are still modest - thanks to these regular gains. The S&P is still clinging on to the neckline of the head-and-shoulder pattern. Volume climbed to register an accumulation day, but the 'spinning top' finish for the day leaves things in a more neutral state. A swing-trade using day's highs/lows as the trigger would be ideal, but an inside day would offer better risk:reward.