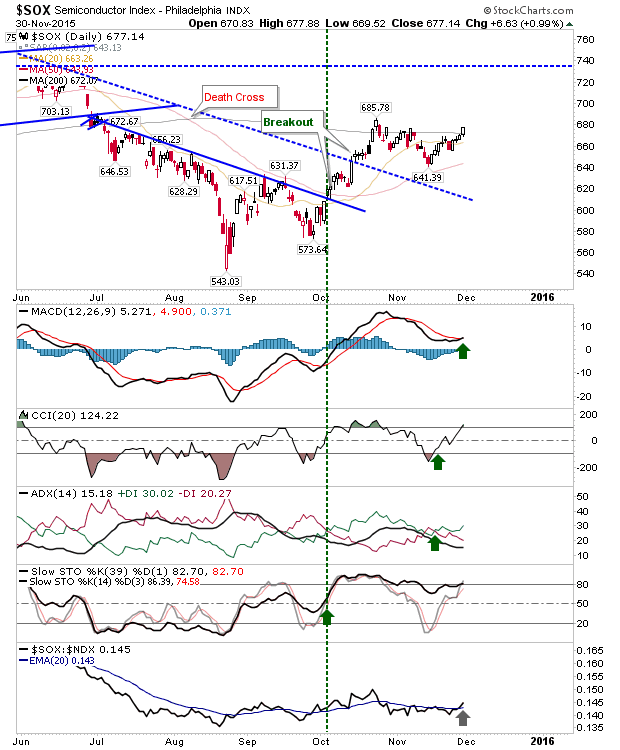

Semiconductor Index Breaks 200-day MA

Today offered a heavier than expected volume day post-holiday. The majority of this action was to the downside, but the Semiconductor Index bucked the trend. The latter index was able to push above its 200-day MA as it posted a relative advantage against the Nasdaq 100. While the Nasdaq and Nasdaq 100 suffered losses today, both will be helped by strength in the Semiconductor Index. All technicals for the Semiconductor Index are in the green, with a return of the MACD to a 'buy' trigger (above the bullish zero line - a bullish development).

The Nasdaq suffered a minor loss. It wasn't able to challenge the recent high, but it's close enough so that a small gain could be enough to make new highs.

The S&P took small losses, but not enough to confirm a break of the (tight) trading range from the last week or two.

The Russell 2000 came off a new swing high, which is still on course to test the 200-day MA. Technicals are still in the green.

Bulls haven't been back since the strong rally from the middle of November. However, bears haven't been able to make the most of their absence. If tomorrow is able to take out Monday's swing high then it will send shorts scrambling.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq suffered a minor loss. It wasn't able to challenge the recent high, but it's close enough so that a small gain could be enough to make new highs.

The S&P took small losses, but not enough to confirm a break of the (tight) trading range from the last week or two.

The Russell 2000 came off a new swing high, which is still on course to test the 200-day MA. Technicals are still in the green.

Bulls haven't been back since the strong rally from the middle of November. However, bears haven't been able to make the most of their absence. If tomorrow is able to take out Monday's swing high then it will send shorts scrambling.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!