2-0 Bulls

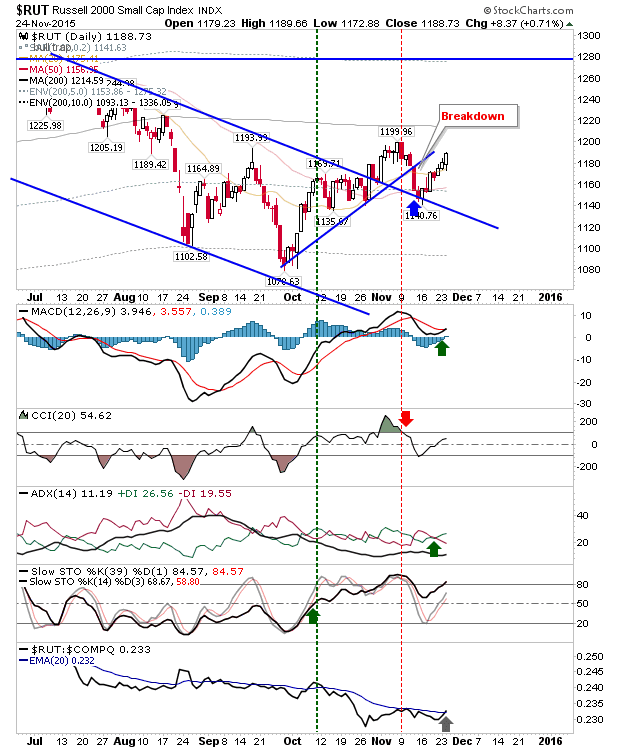

A second day for bulls to shine despite modest end-of-day gains. Some indices did better than others. The Russell 2000 was the key performer. It finished with a MACD trigger 'buy' and looks ready to outperform the Nasdaq 100. This is an important development for bulls looking for more from other indices. A move to challenge - then break - its 200-day MA, would convert August-November action into a healthy basing action.

The Nasdaq registered higher volume accumulation as a brief sojourn below the 20-day MA was reversed. It's nicely set up for a push to new swing highs.

The S&P lost the most ground intraday, but managed to close positive by the close of business. It did clock a relative loss against the Russell 2000. The MACD hasn't yet triggered a 'buy, but is close to doing so.

The Semiconductor Index finished with a bullish engulfing pattern and is continuing to build a solid base. Long term prospects look good, especially as weak copper prices will eventually bring its reward.

For tomorrow, look for bulls to try and make it 3-0.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq registered higher volume accumulation as a brief sojourn below the 20-day MA was reversed. It's nicely set up for a push to new swing highs.

The S&P lost the most ground intraday, but managed to close positive by the close of business. It did clock a relative loss against the Russell 2000. The MACD hasn't yet triggered a 'buy, but is close to doing so.

The Semiconductor Index finished with a bullish engulfing pattern and is continuing to build a solid base. Long term prospects look good, especially as weak copper prices will eventually bring its reward.

For tomorrow, look for bulls to try and make it 3-0.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!