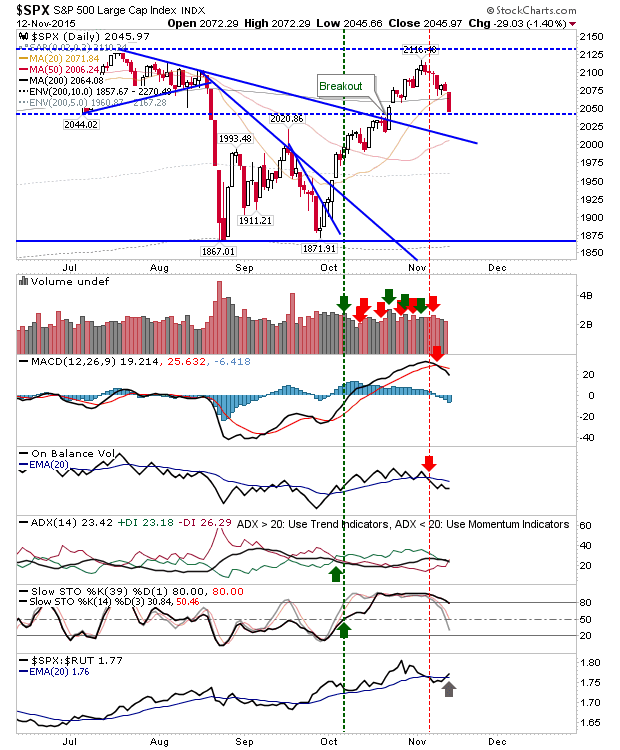

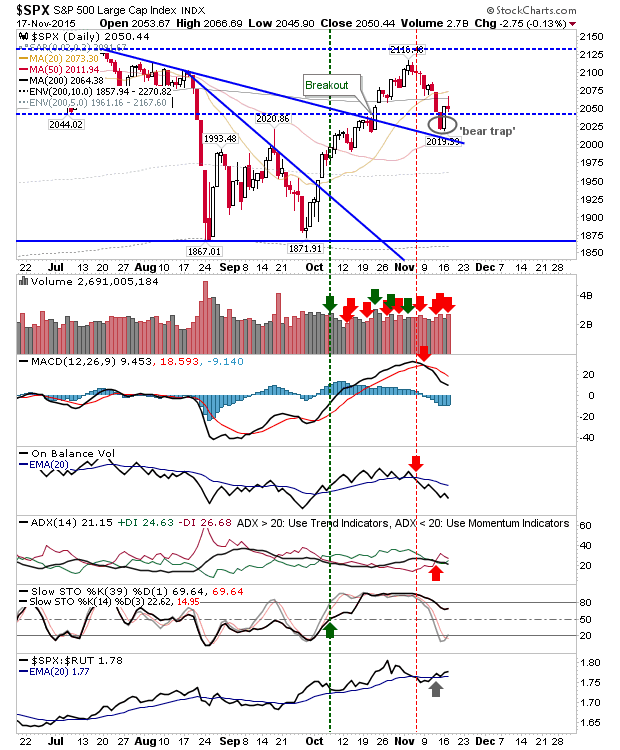

Sellers Reverse Early Gains

It was going to be too much for bulls to follow yesterday's gains with a repeat day, but they were unable to maintain what gains they had achieved by the close of business. This translated into bearish 'gravestone' doji for many of the indices. If true, then be wary of weakness off the open, as this may not reverse after the first half-hour of trading (an intraday reversal point). The S&P has the 'bear trap' to work with, and unless the 2,019 swing low is breached the 'bear trap' remains valid. Volume climbed to register as distribution, and the 200-day MA was tagged as resistance. However, relative performance remains good.