Markets Retain Majority of Gains

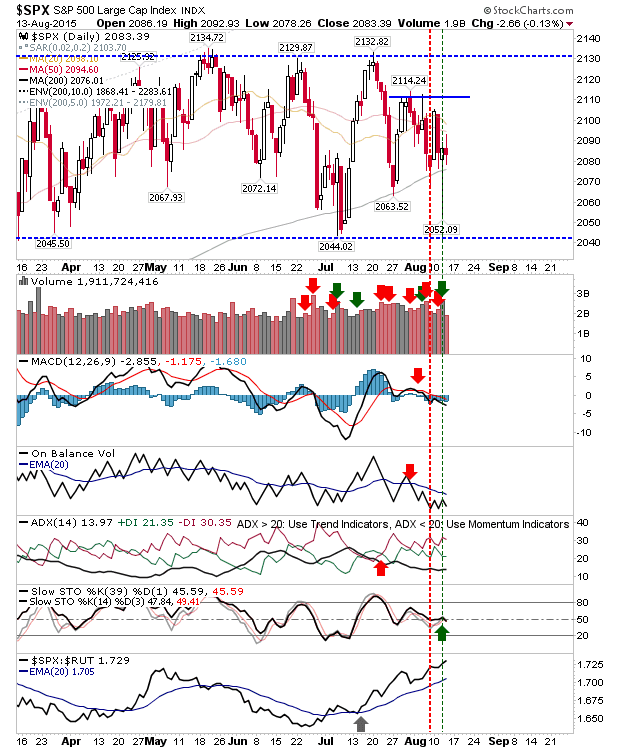

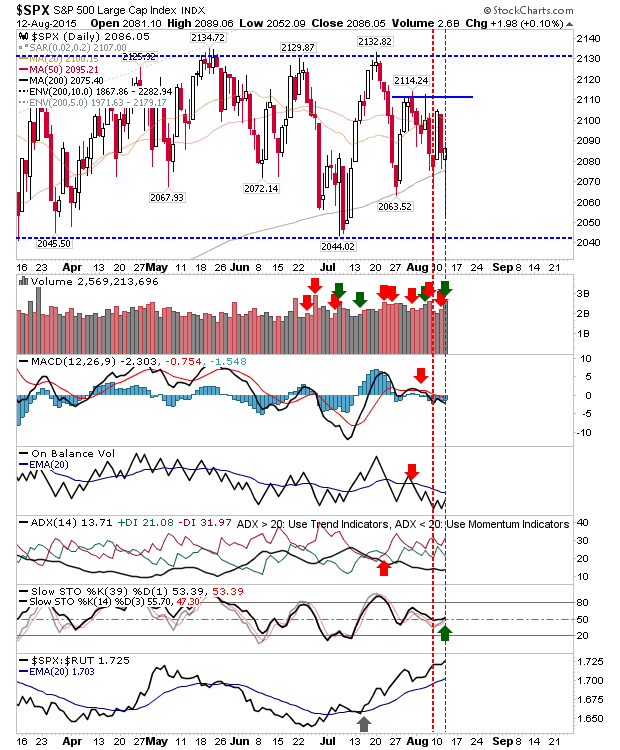

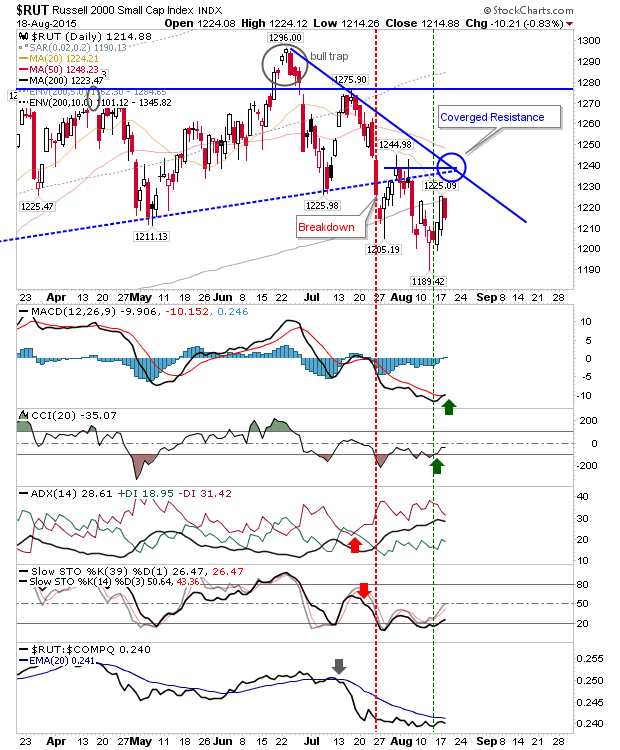

Not a day for big dramatics, but markets did well to hold on to Monday's gains. Selling volume was lighter than yesterday, so today wasn't seen as an opportunity to sell into strength. The one index which was perhaps a little problematic for bulls was the Russell 2000. Here, the index lost nearly 1% as the 200-day MA stayed as resistance. This is he second time sellers have attacked this moving average. If bulls were to have a broader concern, then this index is the canary in the mine. Market leadership comes from Small Caps, and action in this index isn't great. Bulls may look to the weak MACD 'buy' as a sign of something better, but 1,189 will need to hold as support.