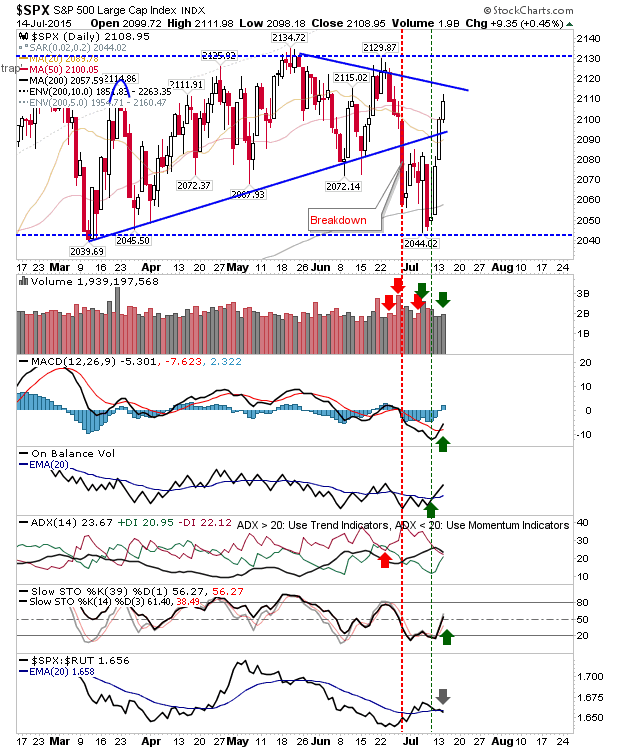

Gains Contained

Monday was a continuation of Friday's action: gains for S&P and Nasdaq, losses for Russell 2000. The issues in play at the start of the day, remain in play at the close. The Russell 2000 is perhaps the most worrying of the indices. Today's losses took the index back to the 50-day MA, but with the index stuck inside a trading range this moving average is unlikely to play as major support. Technicals are also a little iffy: a 'sell' in the ADX is coming up against a potential 'sell' in the MACD, and relatively neutral CCI and Stochastic. The worst of the action is the sharp relative under-performance against the Nasdaq.