Scrappy Consolidation, But Greece In Play

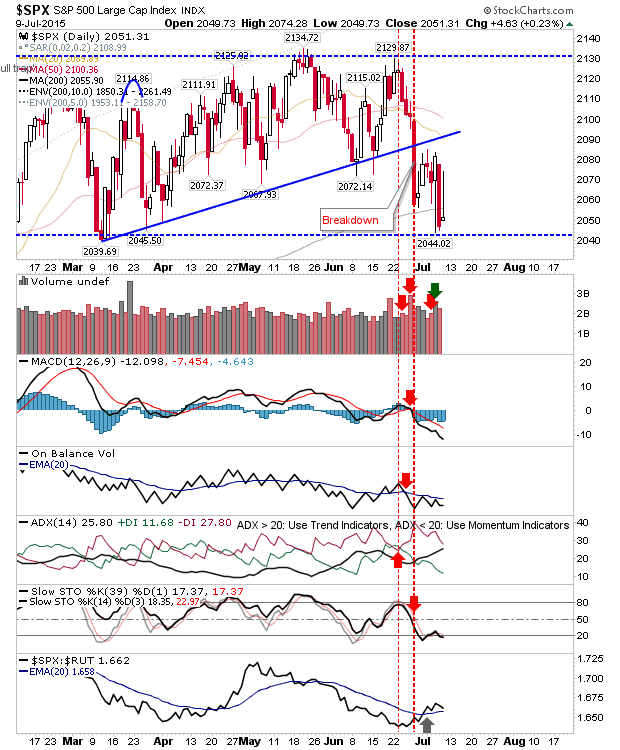

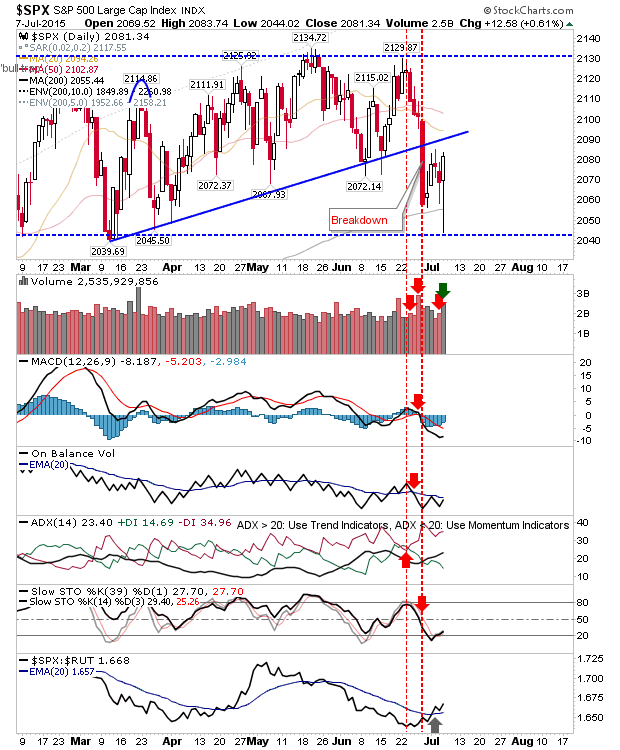

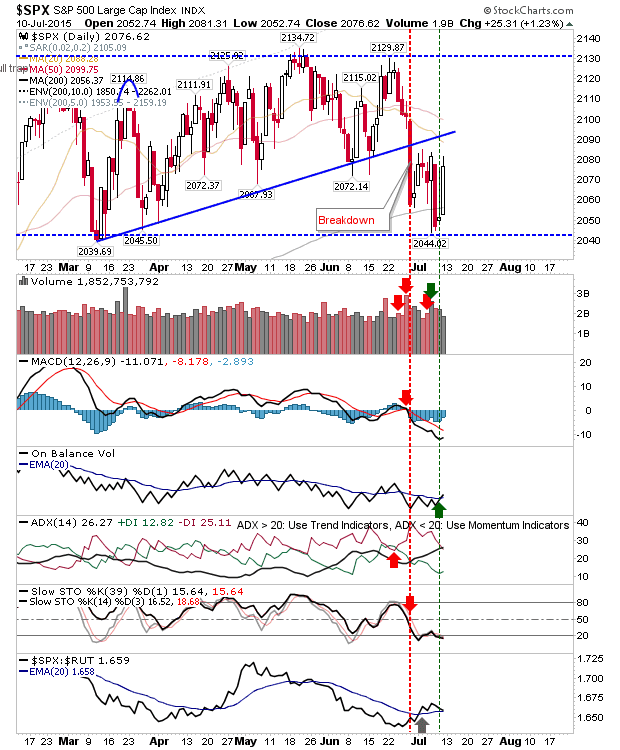

It's not looking good for Greece with Germany holding out , and last week's big swings without any significant change in price is going to change next week. The break down from the end of June looks likely to hold out, and this will keep the intermediate down trend in play. Intermediate trends last from 3 weeks to 6 months, and there is probably enough fuel from Greece and China to keep this going into Autumn. Bulls are not entirely out of the game. The S&P is defending its 200-day MA, with a new 'buy' trigger in On-Balance-Volume, and a continued relative advance against Small Caps. Gap resistance is at 2,085. The Nasdaq also saw an On-Balance-Volume 'Buy' trigger, although the latter volume indicator has flat-lined. Gap resistance for this index sits at 5,038 with the 200-day MA the next target down. The Russell 2000 defended trend-line support, but next week will be a tougher test. Such support is unlikely to survive a fourth test. Tech i