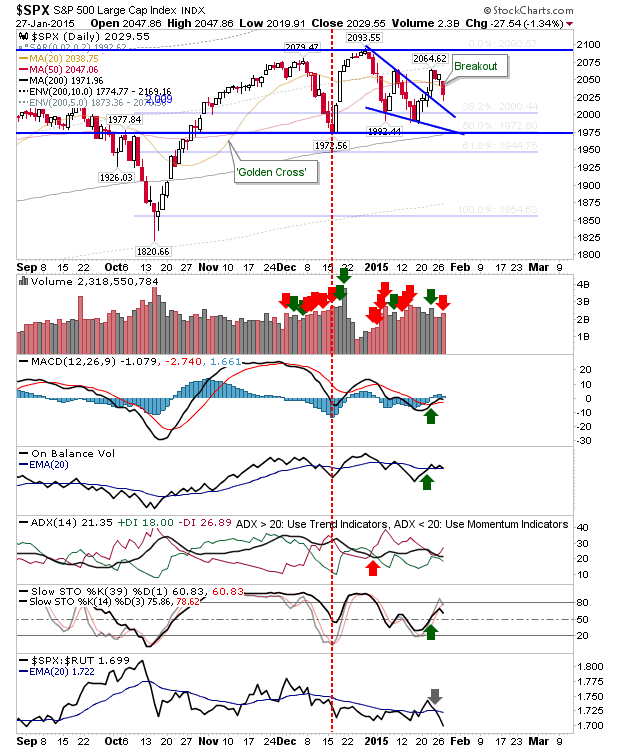

Very little for the investor, and a market offering high whipsaw risk for intraday traders. All lead indices continue their range bound behaviour, caught more or less in the middle of those ranges. Very little to get excited about until either support or resistance break. The S&P had looked like it was attempting to build a head-and-shoulder reversal within the base, but this now appears to be trading flat out of that pattern, and more towards a base-within-base. A couple of positives are the 'buy' signals in the MACD and On-Balance-Volume, which may favour a push above 2,064 and a challenge of 2,090s. Also, yesterday's gain registered as an accumulation day. While some slowing of the advance on a tag of 2,064 is possible, there is good grounding for some more upside.