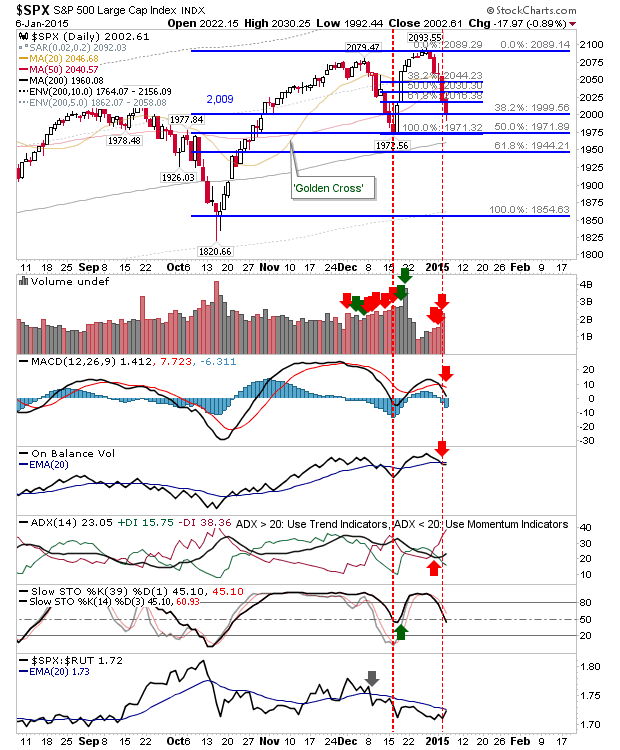

S&P Rallies Past 38% retracement

Well, I got this one wrong. I didn't think the S&P had the juice to put in the day that it did, although volume was perhaps a little disappointing. Volume did enough to register an accumulation day, although buying volume was well down on previous selling volume. In terms of technicals, only On-Balance-Volume generated a 'buy' trigger. All other technicals remain bearish. However, I still don't like this rally, but it must be respected (for now). Because of degree of comeback, a move to 2,087 is favoured, but given the retest of 1,971 failed after the New Year decline, then a test of 2,087 has a high chance of failing too. Most likely long term outcome is a trading range between 2,087 and 1,971.