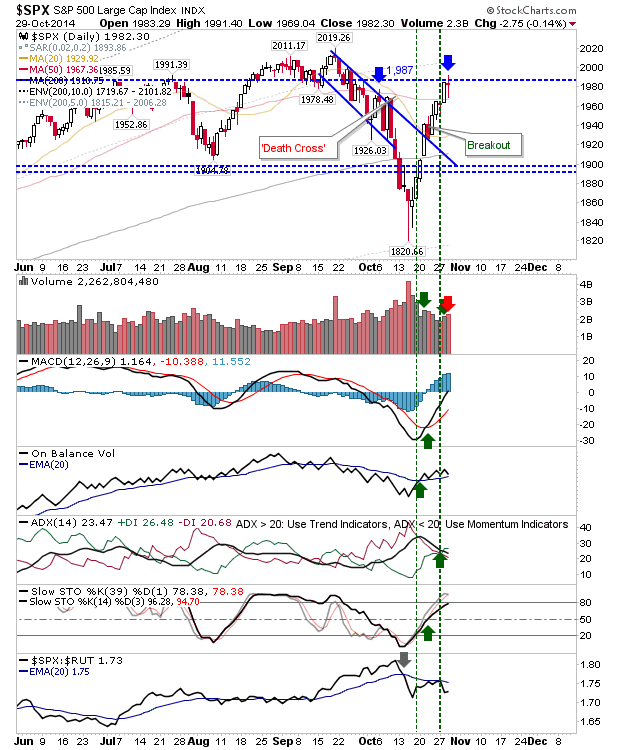

Yesterday's decent gain was followed with a consolidation today. The relatively wide intraday range finished with a flat close; a close which remained in the range of resistance. The S&P has a resistance level at 1,987 based on the July high with supply kicking in around September congestion. This may evolve into a bearish head-and-shoulder reversal: for this to happen, look for a move back to 1,904 (August swing low) without a close above 1,987. Technicals are bullish, along with the bullish trend in the 200-day MA, so a head-and-shoulder reversal would run against the technical picture. The Nasdaq is coming up against former support turned resistance, and may offer itself as a shorting opportunity. Meanwhile, the Russell 2000 is trading around its 200-day MA. Given the relative leadership of this index, and the fact other indices have breezed past their respective 200-day MAs, I wouldn't look for the Russell 2000 to linger here for too long as it continu...