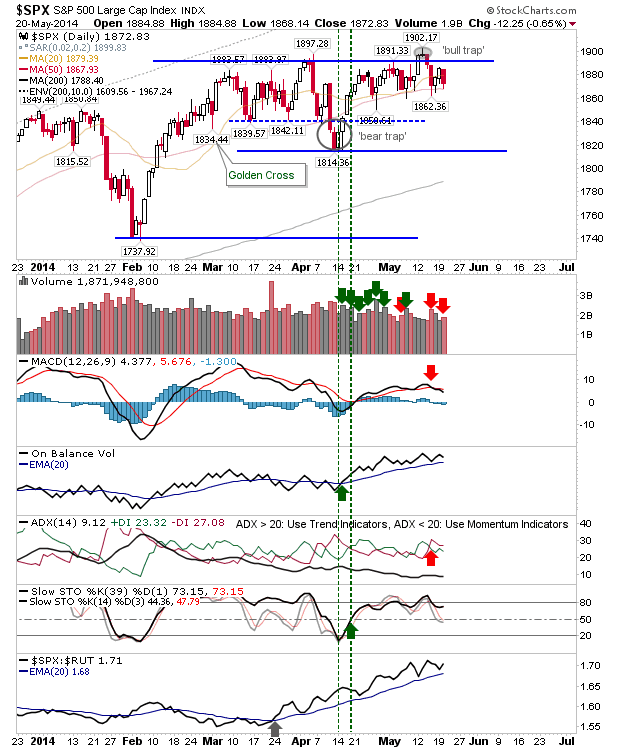

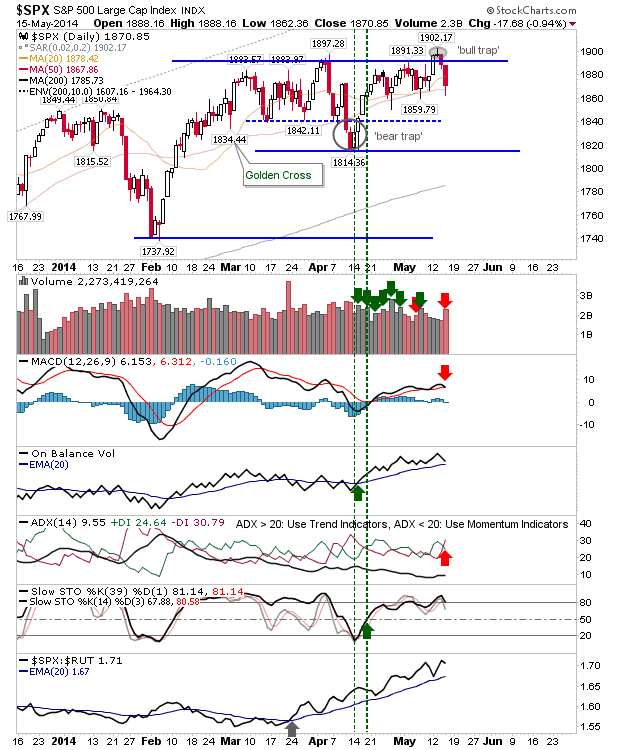

An unusual day of selling. The Russell 2000, which had been the weakest index, managed to rally into the close. The S&P, which had been the strongest index, attracted only limited buying into the close. The S&P held to its 50-day MA, which was perhaps the best thing that could be said for today. Volume climbed in confirmed distribution, the first real sign of selling intent since April's sell off,which suggests further selling is likely in the day's ahead.