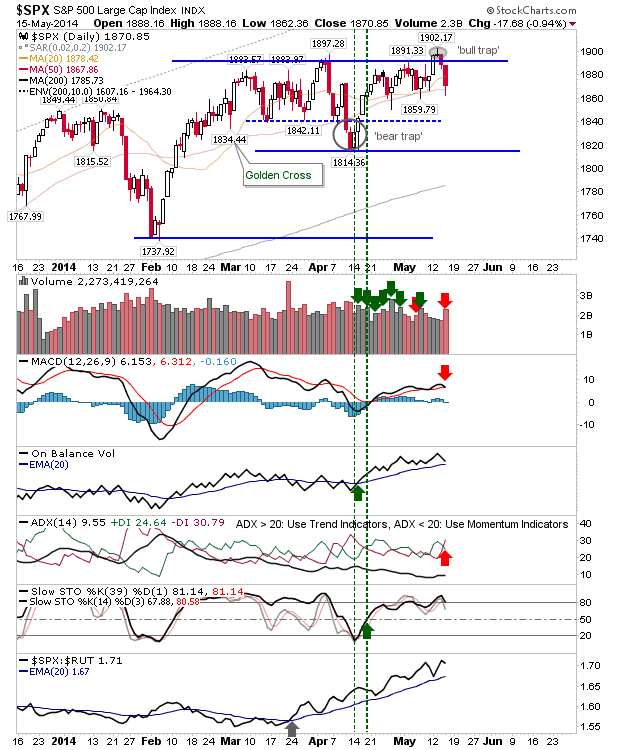

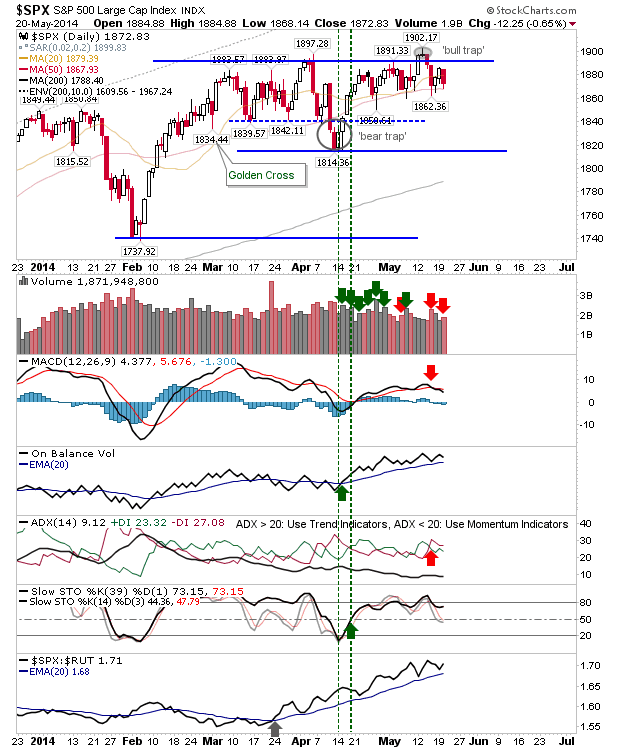

Daily Market Commentary: And The Bull-Bear Dance Continues

Across indices, bears posted a loss to counter yesterday's gain. It didn't change the broader picture, with trading ranges established in all lead indices. The S&P held support at the 50-day MA on higher volume distribution; the second distribution in four days, with no accumulation days for the last of couple of weeks.