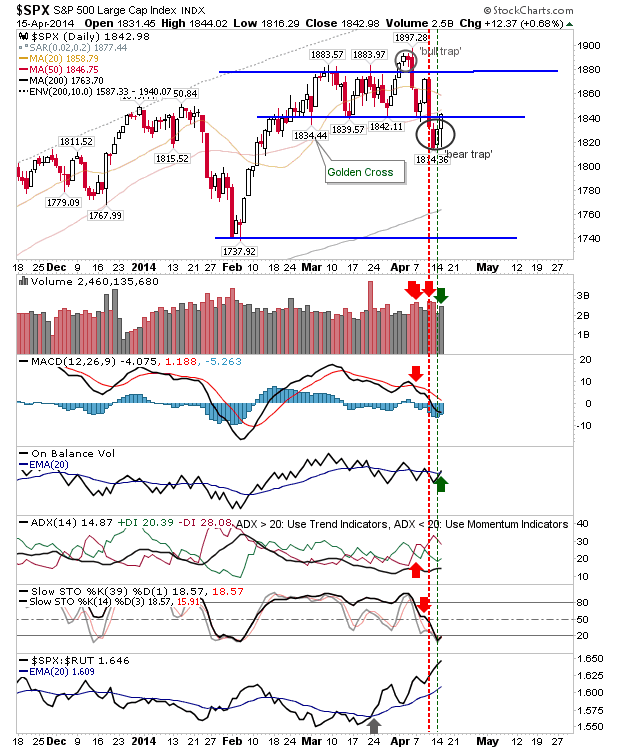

Daily Market Commentary: Scrappy Recovery Continues

It was never going to look pretty, with indices effectively back inside prior trading ranges, with some wedged between 50-day and 200-day MAs too. Narrow range days, with a net bullish bias, is likely to be the order of the day, at least until 50-day MAs are recovered. The two indices best positioned to take advantage of bullish strength are the Dow Industrials and S&P. The Dow has morphed into a market leader, with strength in Transports lending weight to a long term bullish setup as per Dow Theory, although neither has cracked new highs - yet. The Dow does look like it will, and possibly soon. Technicals are all net bullish, and Monday's narrow range day suggests few sellers willing to cash out. A break of 16,600 is looking good.