Daily Market Commentary: Buyers Return At Support

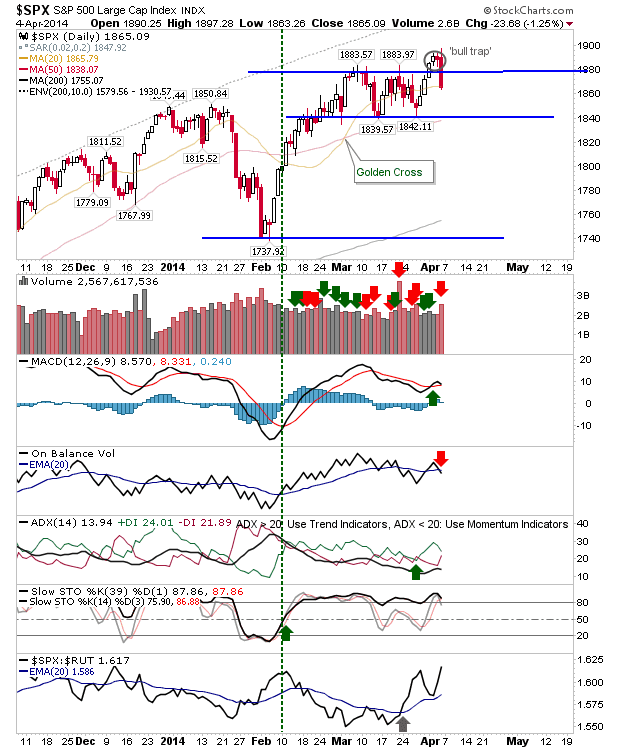

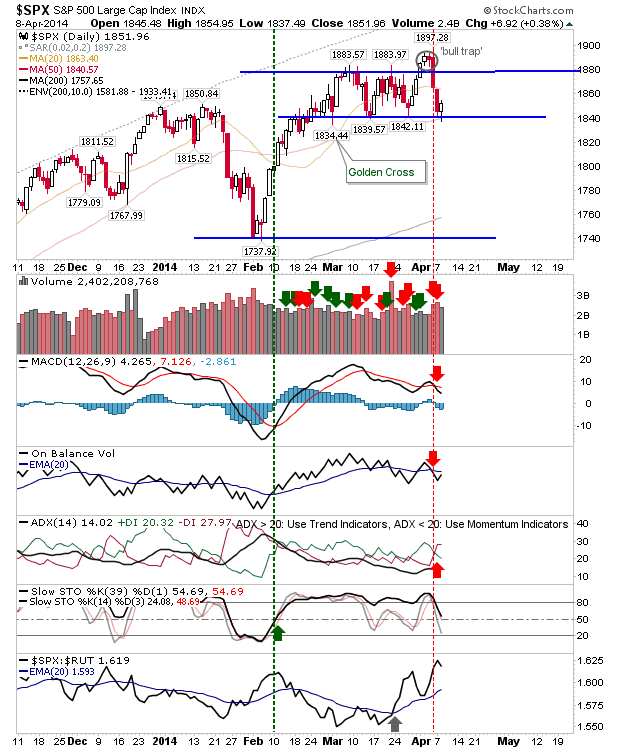

The S&P played to form with buyers coming in at converged support and 50-day MA. There was even a morning sell off and recovery for those nimble enough to take advantage. The intraday picture is nicely set up for an upside breakout. Short term (long) traders might want to take partial profits at 20-day MA, but a larger push to sideways resistance around 1,880 is not out of the question. Risk measured on a close below today's lows.