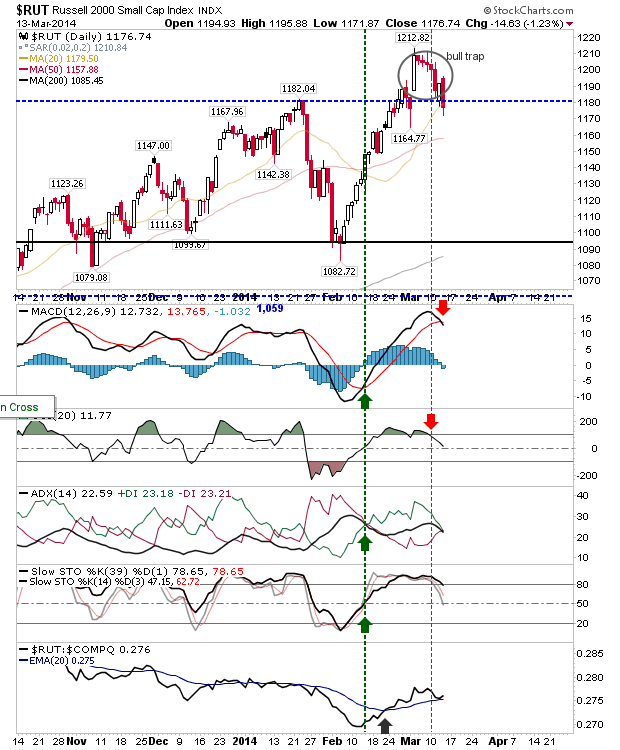

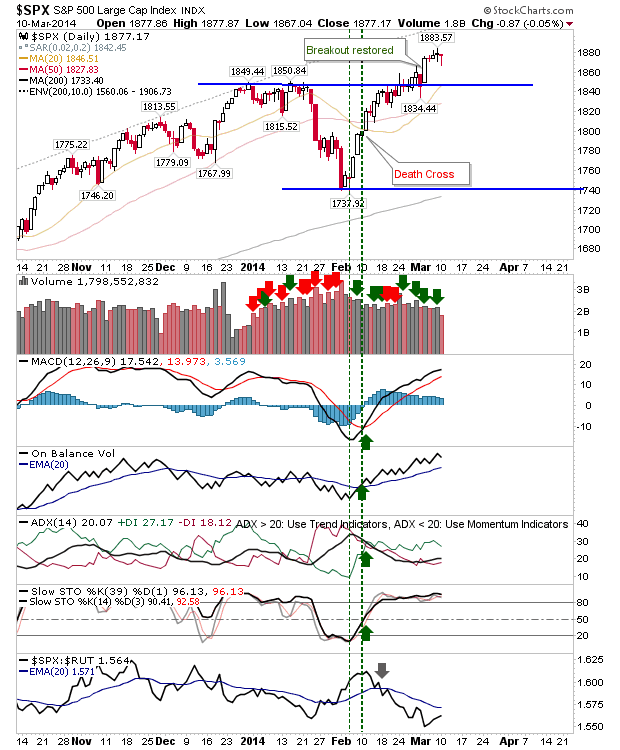

Old news was tied to today's losses, but this is a rich market which if offering more to holders who have held shares over the last 5 years to sell, than those willing to buy.More importantly, it was the first real day of intent from sellers, as up to now, bearish action had been weak. Volume registered as confirmed distribution. Hardest hit was the more speculative Russell 2000. The sizable bearish engulfing pattern effectively wiped out the breakout, leaving a bull trap. The index did finish on its 20-day MA, but I wouldn't get too comfortable with that. There was a 'sell' trigger in the MACD to add to the misery. Even with this, the index is still outperforming the Nasdaq. Shorting opportunities will become available on rallies back to the engulfing high.