Daily Market Commentary: Tension Keeps Building

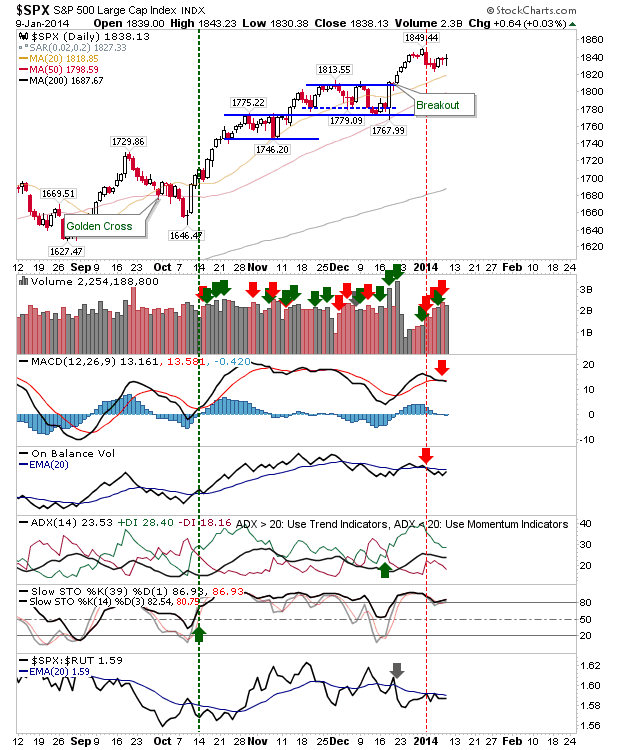

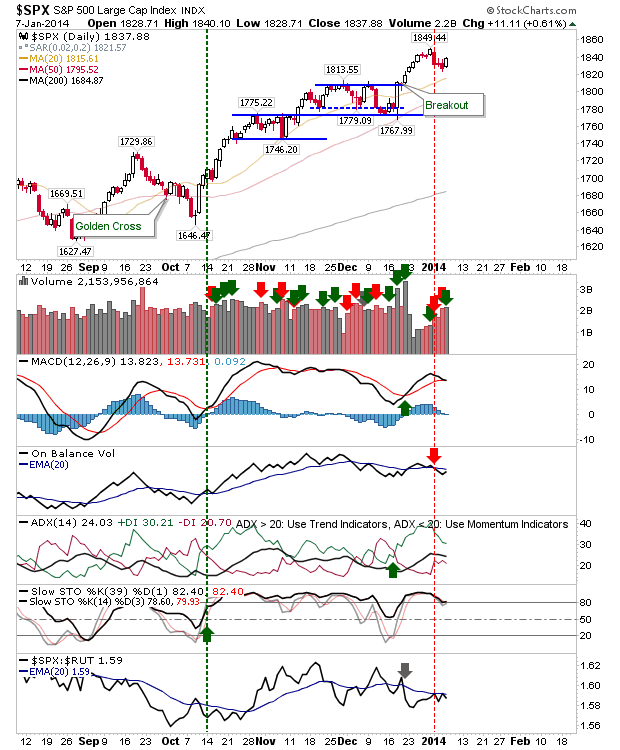

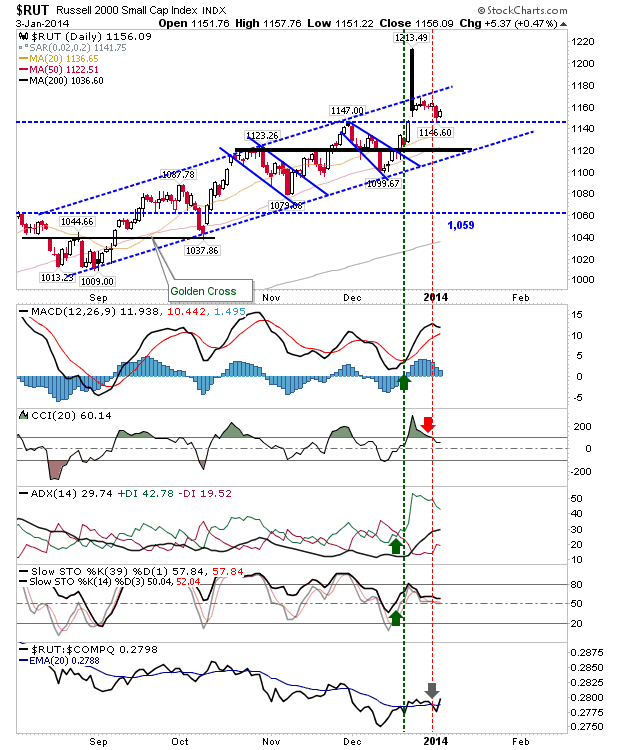

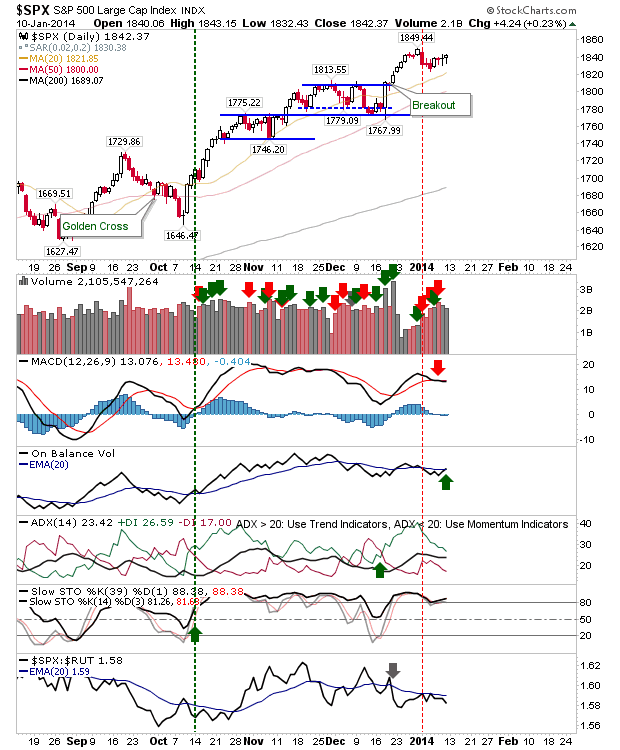

The market looks like it wants to go higher, but nobody wants to be first through the doors. Modest gains covered the decent intraday recovery: whatever about end-of-day gains, intraday action is firmly with bulls. The S&P reversed its On-Balance-Volume 'sell' and is about to do the same to the MACD signal. Be ready for upside on Monday.