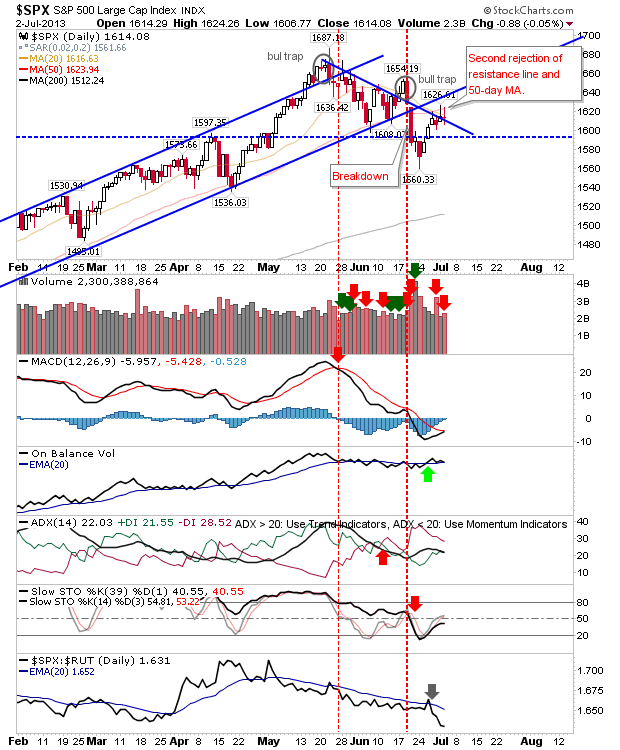

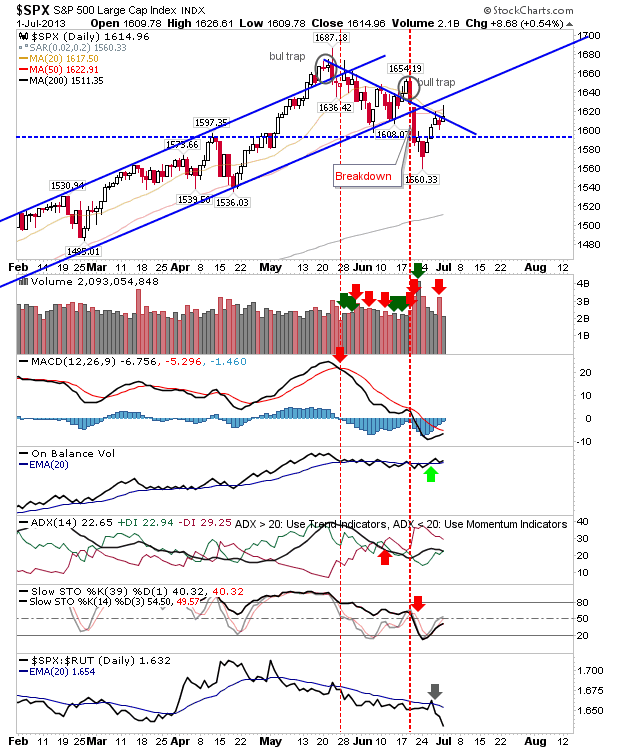

The day started by exceeding expectations. Shorts trying to fade the gap higher would have struggled, but those playing the afternoon drop may have walked away with a profit. However, some indices finished above resistance (50-day MAs), making it a difficult play to predict for Tuesday. Today's weak finish suggests a mini-top for the 5-day rally is in place (stops on a break of today's high), with some indices offering short side opportunities. The S&P had the worst of the action. The index not only failed to hold the break above the 50-day MA, it also failed to hold its breakout. The inverse hammer offers a stop placement at today's high.