Daily Market Commentary: Second Rejection of Resistance in S&P

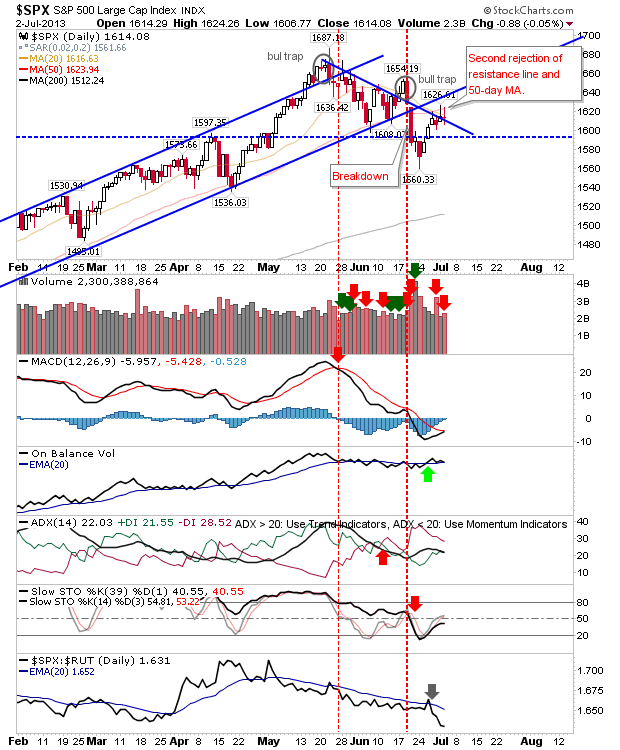

As I write this, Futures are down, but yesterday saw a second rejection of both trendline resistance and the 50-day MA for the S&P. Volume climbed to register a distribution day, although the volume was well off the selling of Monday.

It was a slightly better picture for the Nasdaq. The day finished with a more indecisive doji, but is trading above trendline support and its 50-day MA (but wedged underneath a former upper channel line dating back to the start of 2013). There was also a bullish MACD 'buy' and Stochastic 'buy' to help bulls. Buyers have something to defend, but it won't take much to break them.

The Russell 2000 is the most interesting. Yesterday's action enabled a MACD trigger 'buy' which completed the criteria for a net bullish turn in overall Technical strength: so pullbacks are buying opportunities, with the 50-day MA the most logical place to start. Relative strength has continued to favour Small Caps, so weakness in the S&P may simply be confirmation as to where to be long (Small Caps) rather than a "we are all going to die". A break of June's swing low in the Russell 2000 would be a concern for long term holders of Small Caps, but the index has violated its 50-day MA and come back strong, so traders may need to be more flexible in their risk management if looking to nip at short term trades.

Futures point to a weak open and likely gap down. Watch for a morning fill of the gap, which may offer a short side play into the close. S&P is weakest of indices if looking to play the short trade overnight, but Nasdaq and Russell 2000 aren't weak enough to support an overnight short trade.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

It was a slightly better picture for the Nasdaq. The day finished with a more indecisive doji, but is trading above trendline support and its 50-day MA (but wedged underneath a former upper channel line dating back to the start of 2013). There was also a bullish MACD 'buy' and Stochastic 'buy' to help bulls. Buyers have something to defend, but it won't take much to break them.

The Russell 2000 is the most interesting. Yesterday's action enabled a MACD trigger 'buy' which completed the criteria for a net bullish turn in overall Technical strength: so pullbacks are buying opportunities, with the 50-day MA the most logical place to start. Relative strength has continued to favour Small Caps, so weakness in the S&P may simply be confirmation as to where to be long (Small Caps) rather than a "we are all going to die". A break of June's swing low in the Russell 2000 would be a concern for long term holders of Small Caps, but the index has violated its 50-day MA and come back strong, so traders may need to be more flexible in their risk management if looking to nip at short term trades.

Futures point to a weak open and likely gap down. Watch for a morning fill of the gap, which may offer a short side play into the close. S&P is weakest of indices if looking to play the short trade overnight, but Nasdaq and Russell 2000 aren't weak enough to support an overnight short trade.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!