Daily Market Commentary: Good Day For Semiconductors

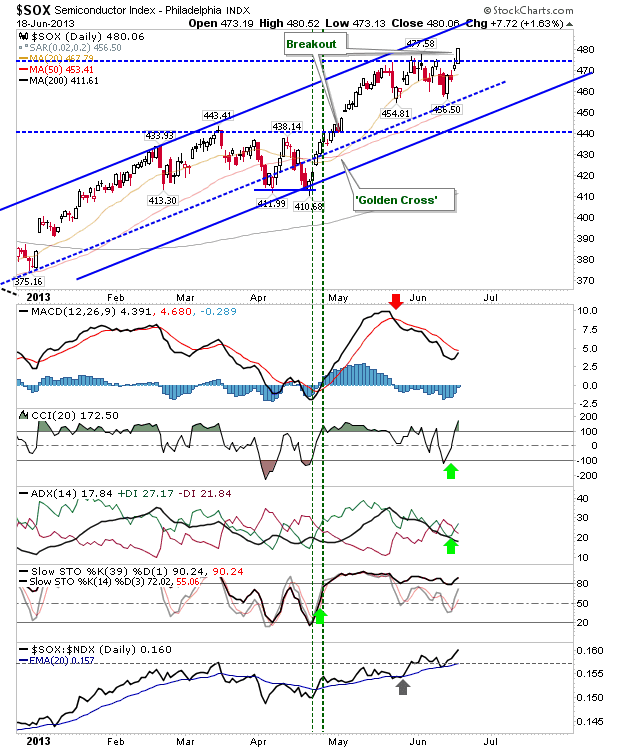

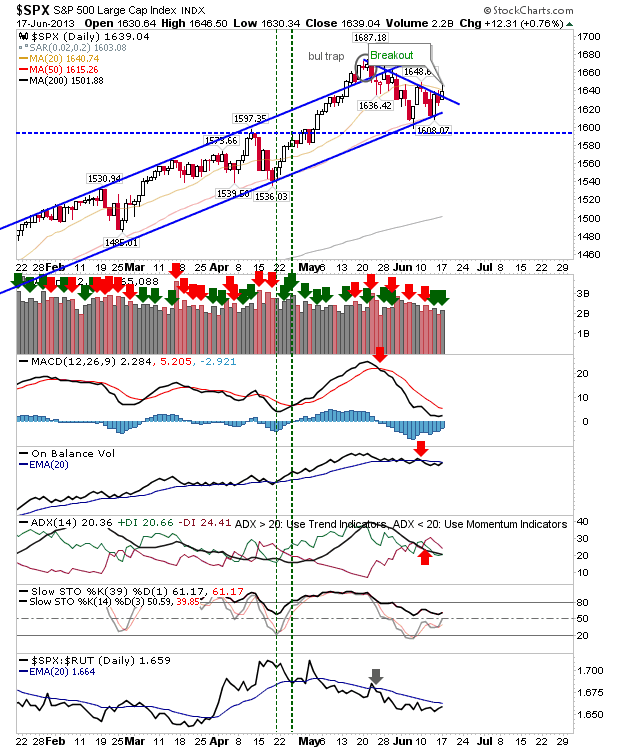

Markets made a reasonable stab at recovering yesterday's losses. Markets gapped higher at the open, but they weren't able to build on the opening gaps. Small Caps edged the gain winners, adding just over 1% on the day. However, semiconductors had a very good day: adding 2.4%, closing above the 50-day MA and a minor channel support level - leaving behind a 'bear trap' in the process. This should help the Nasdaq and Nasdaq 100 and offer a good opportunity for some upside follow through.