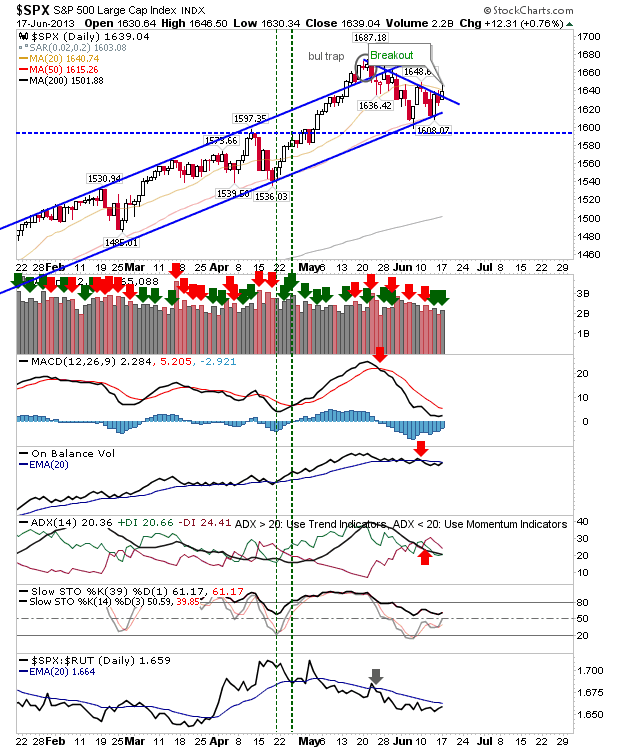

Daily Market Commentary: Watch for Bull Traps

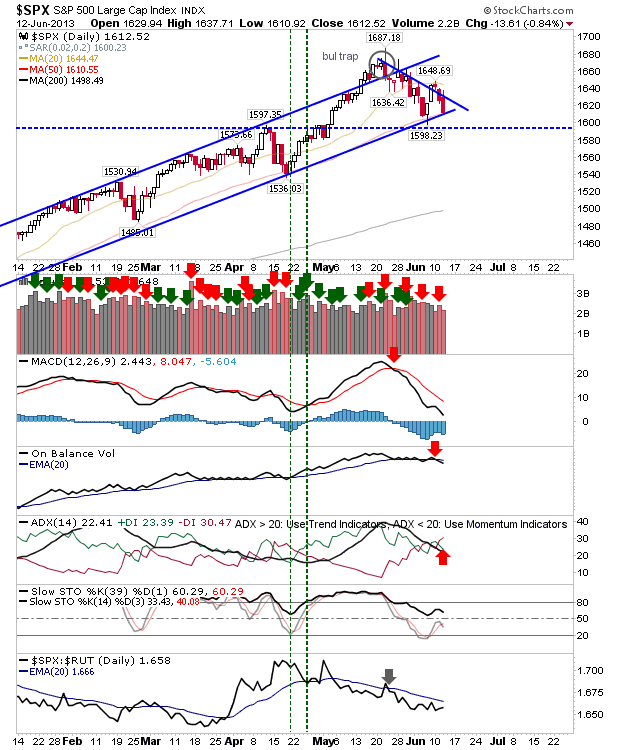

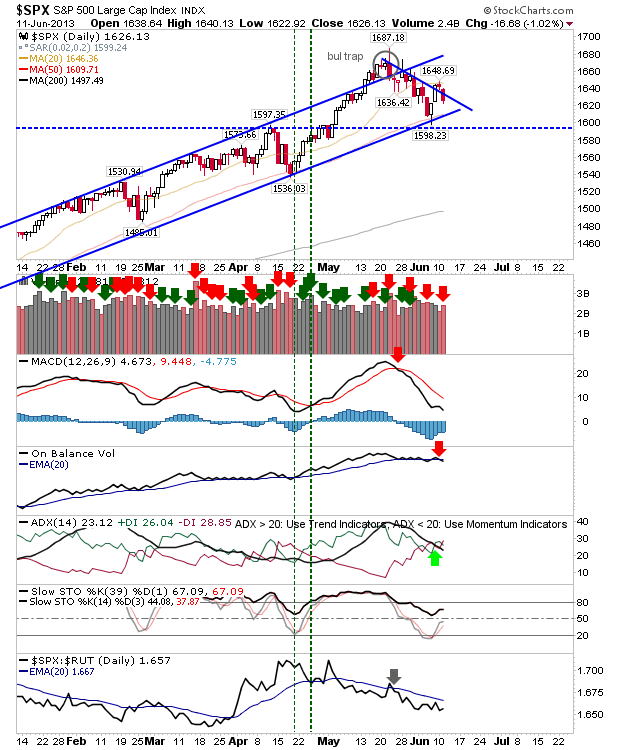

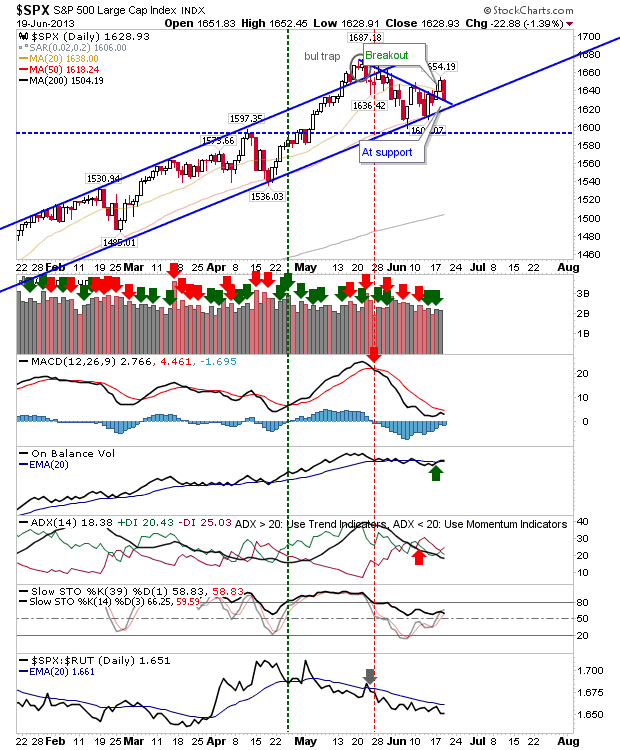

The Fed induced sell off undid the gains generated by bulls yesterday, but the selling wasn't enough to write off the breakouts altogether. However, another day of selling tomorrow will lead to breakout failure, trapping those buyers. Bulls aren't totally out of the picture - the breakouts haven't failed, and indices are closer to support. Buying at the open with a tight stop could be an interesting day trade: the S&P illustrates the long side potential with a stop on a break of the 50-day MA which is also channel support.