Daily Market Commentary: Watch for Bull Traps

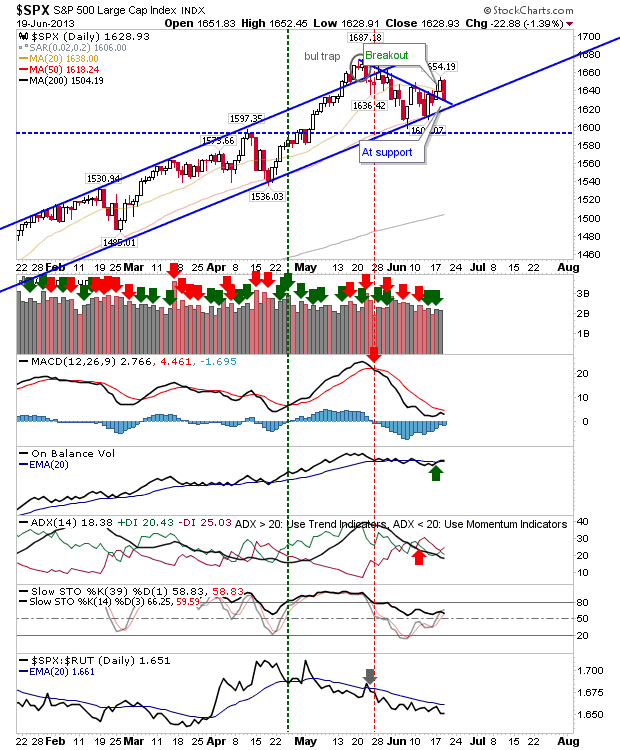

The Fed induced sell off undid the gains generated by bulls yesterday, but the selling wasn't enough to write off the breakouts altogether. However, another day of selling tomorrow will lead to breakout failure, trapping those buyers. Bulls aren't totally out of the picture - the breakouts haven't failed, and indices are closer to support. Buying at the open with a tight stop could be an interesting day trade: the S&P illustrates the long side potential with a stop on a break of the 50-day MA which is also channel support.

The Nasdaq offers a similar opportunity as the S&P: technicals are a little more bullish, plus, it's outperforming the S&P in relative terms.

The Russell 2000 is outperforming the Nasdaq, although it's a little more vulnerable when it comes to placing a protective stop. There is no obvious channel support, and the 50-day MA is a distance away.

The likelihood is for selling to continue, but the nimble may be able to steal a quick long trade if there is any hesitation on the part of bulls. Remember, breadth metrics are overbought and side with bears, but the broader trend is bullish, and the trend won't disappear without a fight - a fight which has an obvious starting point tomorrow.

All Contributions Welcome!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq offers a similar opportunity as the S&P: technicals are a little more bullish, plus, it's outperforming the S&P in relative terms.

The Russell 2000 is outperforming the Nasdaq, although it's a little more vulnerable when it comes to placing a protective stop. There is no obvious channel support, and the 50-day MA is a distance away.

The likelihood is for selling to continue, but the nimble may be able to steal a quick long trade if there is any hesitation on the part of bulls. Remember, breadth metrics are overbought and side with bears, but the broader trend is bullish, and the trend won't disappear without a fight - a fight which has an obvious starting point tomorrow.

All Contributions Welcome!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!