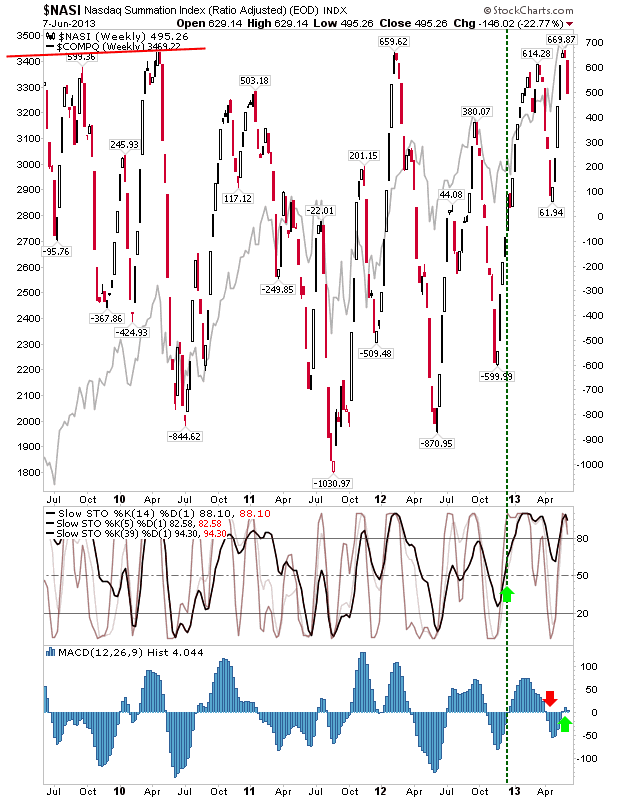

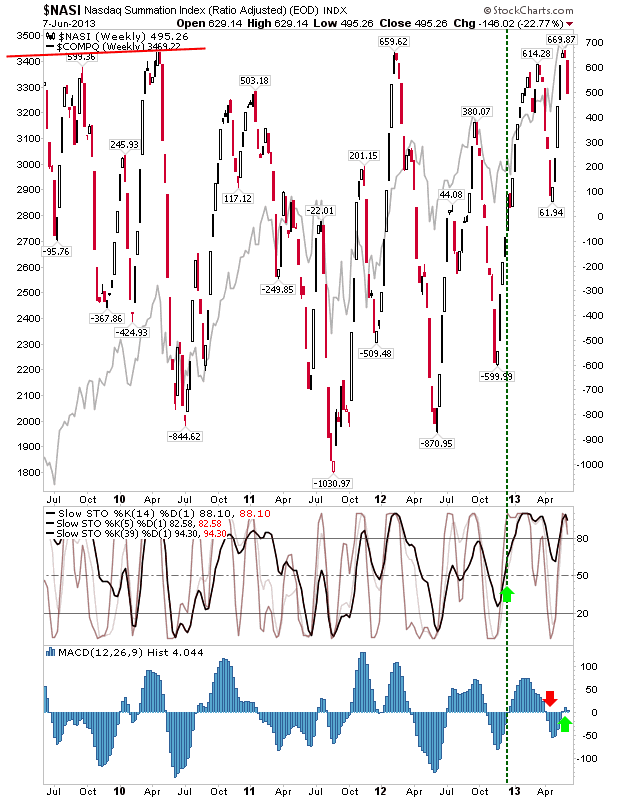

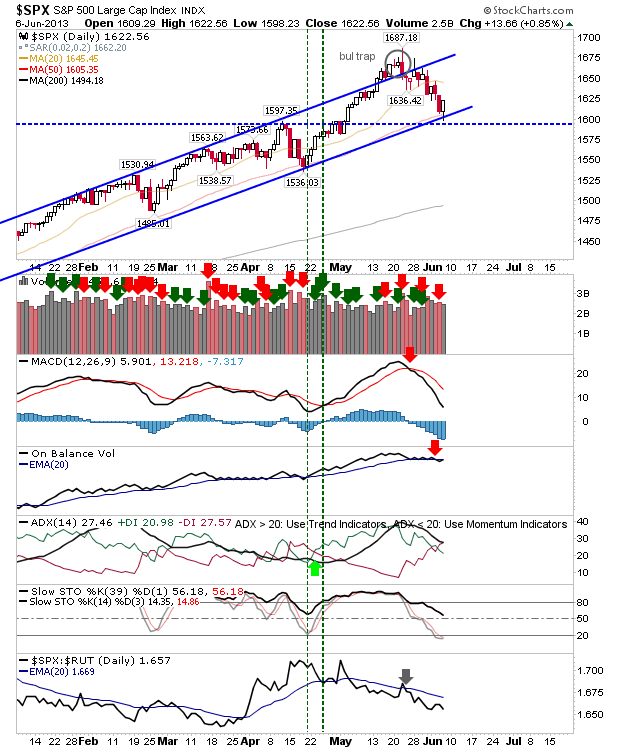

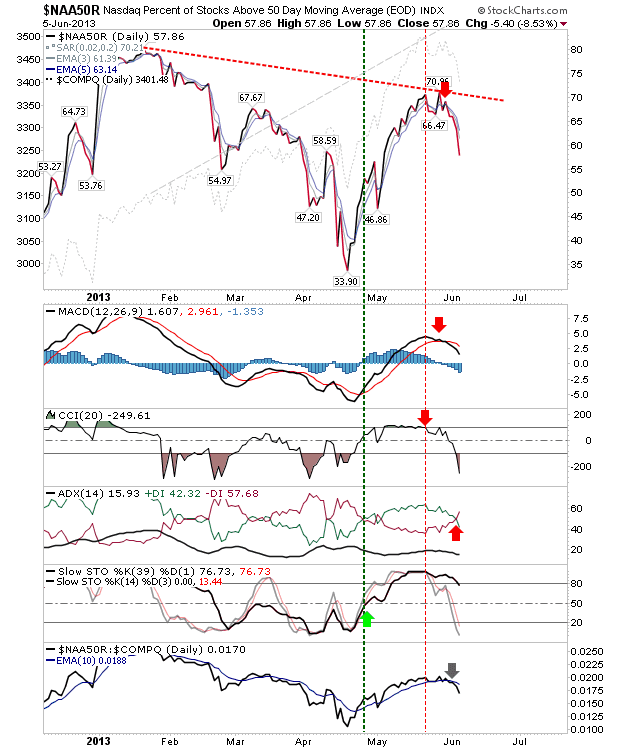

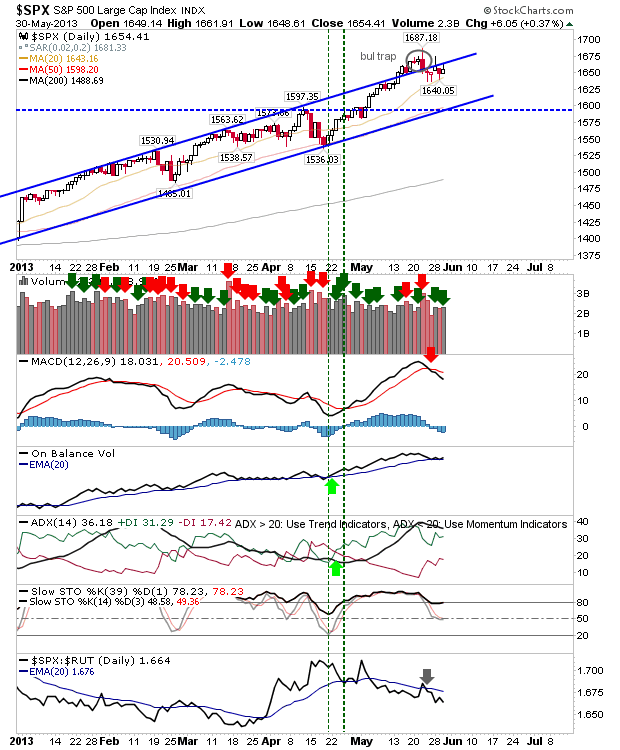

The push from the April swing low (in the Nasdaq) was premature in breadth indicators had not reached oversold conditions, so it hasn't taken the long for breadth to again become overbought. However, the recent similarities to March suggest this may prove nothing more than a pullback of the larger advance, although more downside is needed to at least take the heat out of the breadth indicators. Ideally, a more substantial decline would push breadth indicators into a situation where a tradeable (buy) low would emerge, but this will take a while.