Daily Market Commentary: Bulls Pressure

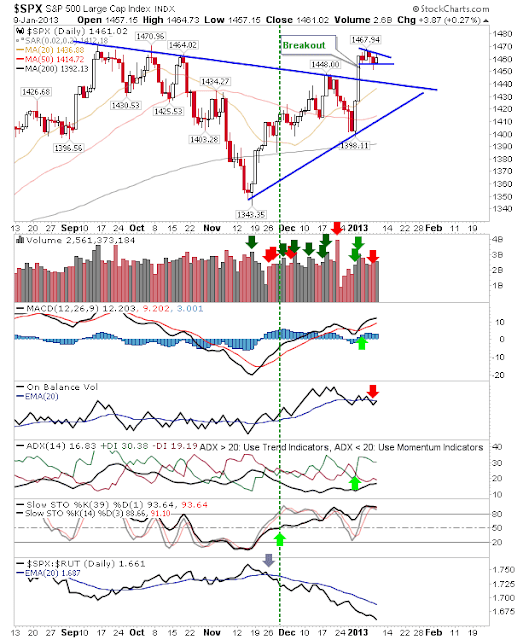

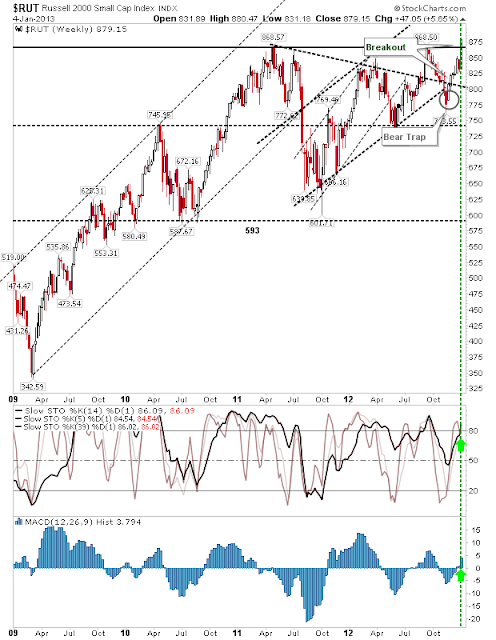

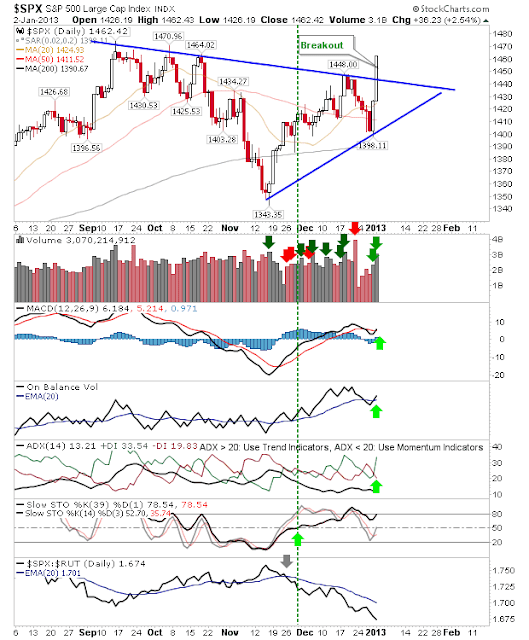

Bulls give an inclination of the pressure they are exerting on the market, although the jump out of the gates at the start of the day wasn't built on. The Russell 2000 remained the lead index with a respectable gain, but there was no advance on the morning gap. The Nasdaq popped its head over the 5-day consolidation resistance, with On-Balance-Volume returning to a 'buy' trigger, although the volume trend remains bearish. The S&P also cleared its consolidation on higher volume accumulation. Technical strength remains good, even if relative strength clearly shows the index as a laggard. Will Friday deliver the bullish follow through? Today marked breakouts for the key indices, but there is a risk of 'false breakouts', particularly if indices are pushed back into the prior 5-day consolidation. A break of the 6-day low for any of the aforementioned indices would mark a confirmed 'false breakout' and offer a short play. --- Follow Me on