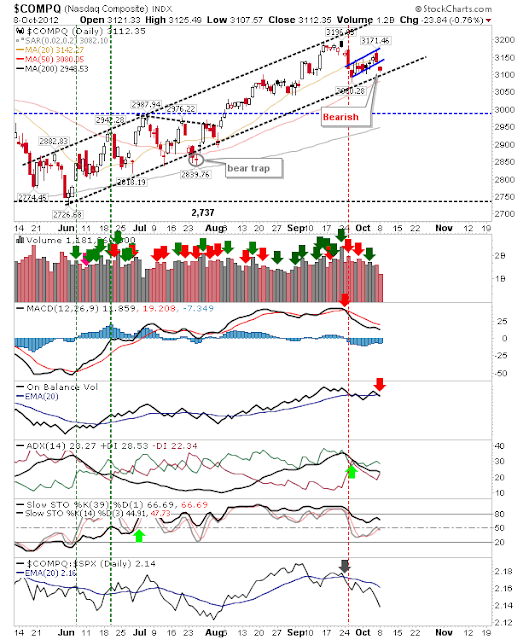

Daily Market Commentary: Finish Near Days' Lows

Bulls attempted a morning rush with strong opening gaps, but there was no expansion, and markets drifted lower to close at new lows. Large Caps were least impacted by the selling, going as far as to finish with a small gain. A move to channel support will provide bulls with an angle for attack, look for this in the first hour of trading. The Nasdaq finished the day with a bearish engulfing pattern, although pattern significance is reduced in the absence of overbought conditions. Again, the 200-day MA is looking like a good downside target. The Russell 2000 offers the best long side opportunity. The index managed a small gain on the day, but the 50-day MA and trendline support are close together, along with key horizontal support. Stops can go on a loss of 815. The Nasdaq 100 is also offering a support buy at the trendline, although the index is caught between its 50-day and 200-day MA. Will markets offer bulls something tomorrow? The Russell 2000 and th...