Daily Market Commentary: Modest Loss

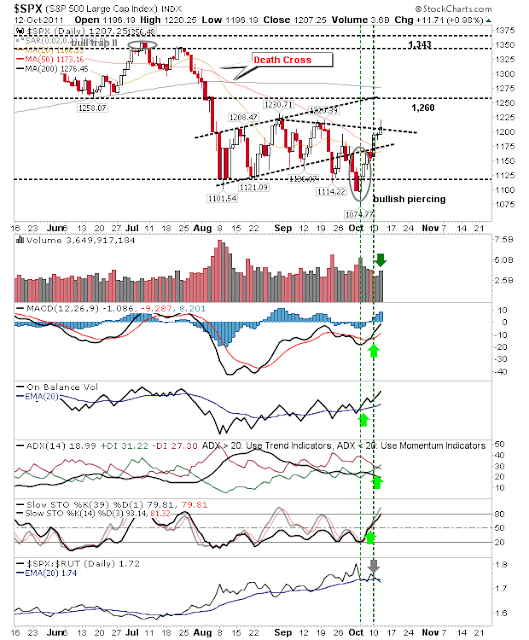

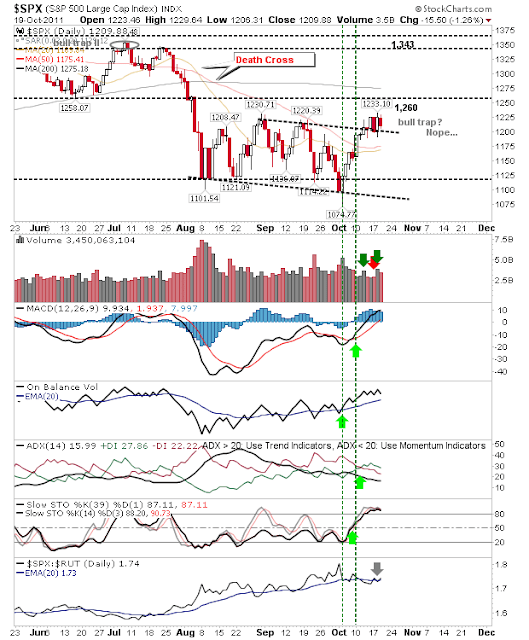

Yesterday's gains were a bit of a surprise given Monday's selloff in an overbought market. Today was a fresh opportunity for bears to launch another attack, but in the end a late day sell off was the best they could do to push markets lower. Volume was also lighter. Tomorrow is another opportunity for bears to create an advantage with indices lurking close to support. The S&P is holding above channel resistance-turned-support. Nearest resistance sits at 1,260 and support at a converging (and rising) 20-day and 50-day MAs. Today's selling should lead to a test of these MAs before bulls show their hand. The Nasdaq has support at 2,616 with today's close was below that, but there is probably enough mojo here to consider it at support. A 'bullish flag' may be taking shape, although the volume pattern doesn't quite fit. If true, tomorrow or Friday should see a gap higher followed by a strong day. The Russell 2000 has been caught in the middle. St