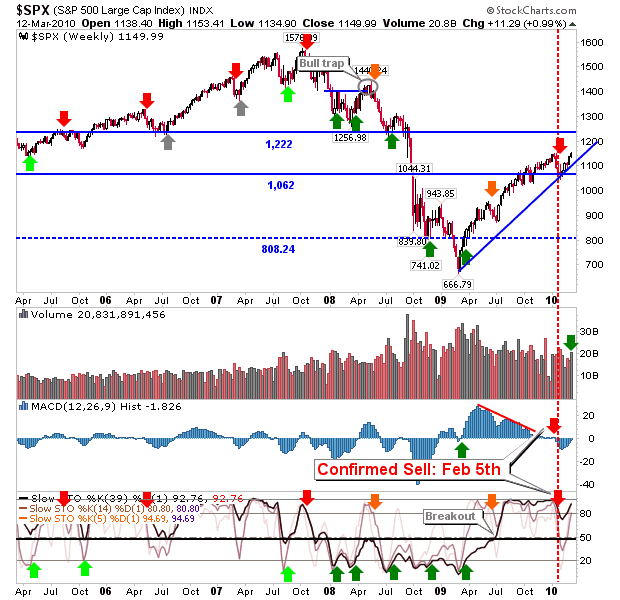

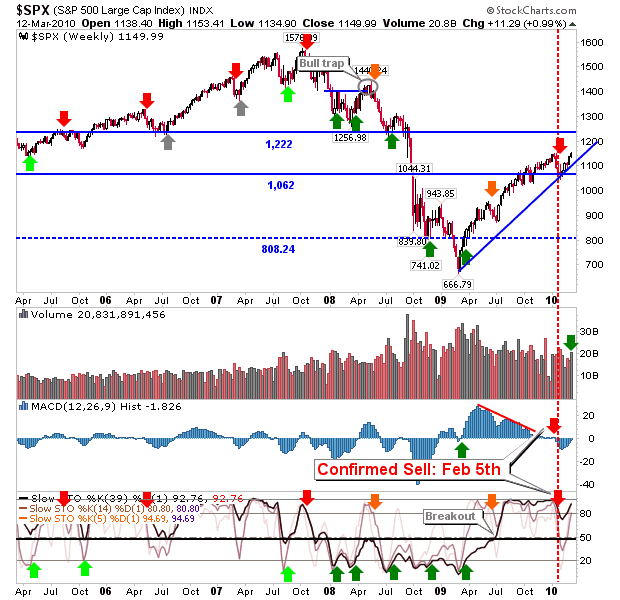

The first attempt at a top in January ceased to be with this week's close at new highs. For the S&P there is a series of reaction lows in 2008 which kick in at 1,222 and range up to 1,260.

The Nasdaq has long since passed 2008 reaction lows and is fast approaching the first of the 2008 reaction highs.

The Nasdaq has long since passed 2008 reaction lows and is fast approaching the first of the 2008 reaction highs.

The Nasdaq 100 is only some 50 points away from the first of the two reaction highs in 2008; it could reach this point by the end of next week.

Breadth saw significant changes. First there was a confirmed 'buy' in the Nasdaq Percentage of Stocks above 50-day MA - although it is fast approaching declining resistance.

Same with the Nasdaq Summation Index (confirmed 'buy' on Mar 1st)

But there was resistance break for the NYSE Summation Index on its confirmed 'buy' signal for March 8th.

But not all resistance has cleared for large cap's market internals

So while internals have shifted net bullish the change came from non-oversold conditions; so this boost is unlikely to last for long. Look for markets to make it to 2008 reaction highs with the Nasdaq 100 to lead.

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!